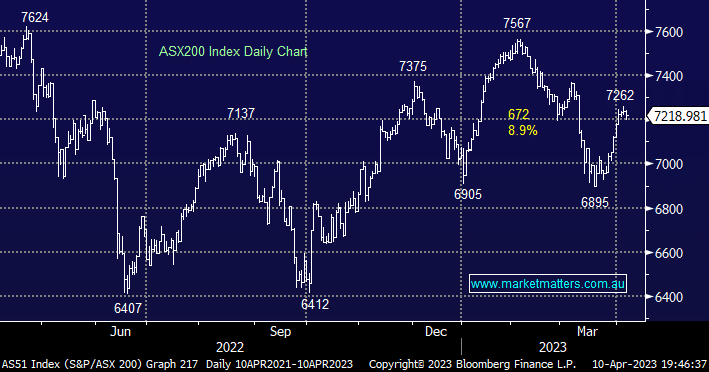

The ASX200 rallied strongly into Easter but our preferred scenario is we will now see a period of consolidation after the 300-point rally over recent weeks however as May looms we are likely to migrate down the “risk curve” to afford us some flexibility if we see yet another period of seasonal weakness.

- With the banking crisis already behind us and markets believing central banks are at or near a pivot point, a test of 7300 wouldn’t surprise over the coming weeks.

- The local market is set to open basically unchanged this morning after a fairly innocuous period for overseas news and markets.

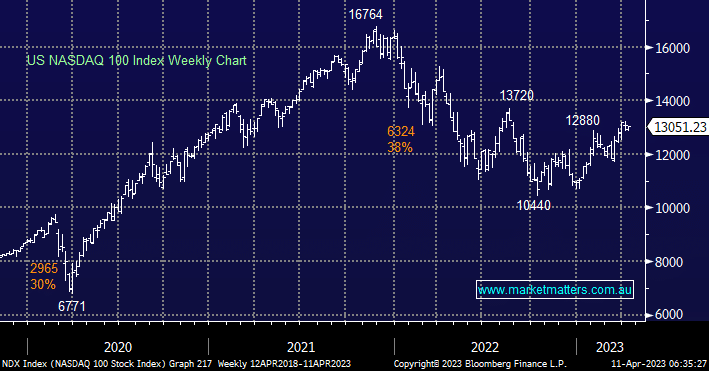

US stocks experienced a mixed session post-Easter with the Dow closing up +0.3% while the tech-based NASDAQ slipped -0.1% but the standout of the night was the market’s strong recovery from a sharp intraday sell-off e.g. the S&P500 eked out a +0.1% gain after initially falling ~0.8% on fears of another rate hike in May. The read-through being the markets are not keen on another rate hike next month but it’s capable of taking one in its stride.

Overnight Apple Inc. (AAPL US) slipped -1.6% on the news that personal computer sales fell sharply, although again the goliath bounced strongly from its low suggesting there are still plenty of buyers into dips.

- No change, in our opinion now the US NASDAQ 100 has weathered the banking storm it can rally towards 13,700 resistance over the coming weeks

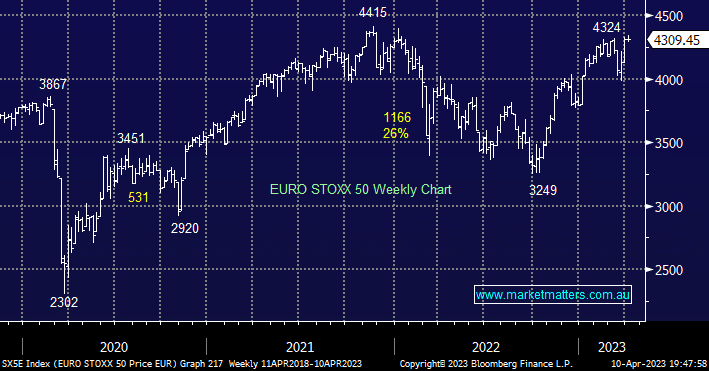

European stocks had a very quiet run into Easter, and with US markets delivering no major lead they look set for a similar start to the shortened week this evening.

- The EURO STOXX remains well positioned well to make a fresh 2023 high after absorbing the uncertainty from its Banking Sector.