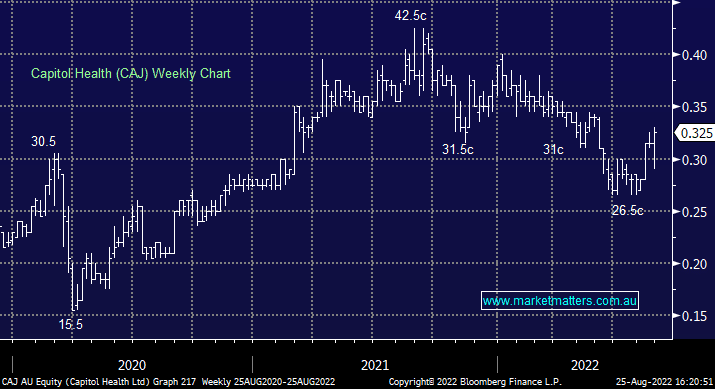

CAJ +4.84%: the diagnostic imaging company reported FY22 results today, coupled with an accretive acquisition that saw shares trade higher. Revenue grew 3.5%, and although it was down 3.5% in the second half, the fall was less than that implied by Medicare data. EBITDA was down 14% to $41m in line with market expectations. They extended the buyback which was left untouched in FY22, highlighting the strong balance sheet position the company holds. Capital Health has also announced the acquisition of FMIG for $56.1m, adding another 6 clinics in Victoria. The acquisition will add 16% to EBITDA and is expected to generate high single-digit EPS accretion.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM is bullish CAJ and long in the Emerging Companies Portfolio

Add To Hit List

Related Q&A

Reporting update on 3 stocks- CRN, CAJ and MVF

Is Capitol Health (CAJ) making a come back?

Thoughts on Capitol Health, Austal and Standline Resources?

Thoughts on CAJ & SUL please

Thoughts on Audinate and Capital Health please?

What’s MM’s current view on Capitol Health (CAJ)?

Thoughts on – CAJ, HLS & ING please?

Any updated views on CAJ?

Does MM like healthcare stocks HLS & CAJ?

Capital Health (CAJ) + Super Retail (SUL)

When should we cut our losers?

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.