Hi John,

We often preach that investors need to be flexible and open-minded and this is indeed how we approach positions if / when they drift against us, unfortunately an inevitability happens at times. The question to ask is “would I be a buyer here if I had no position, if the answer is no we need to question if we should be holding the position at all. In other words, have a thesis for buying and consistently question that thesis irrespective of whether the stock is up or down. If the thesis is not broken, hold or buy more, if it is broken or has been eroded, reduce or sell completely.

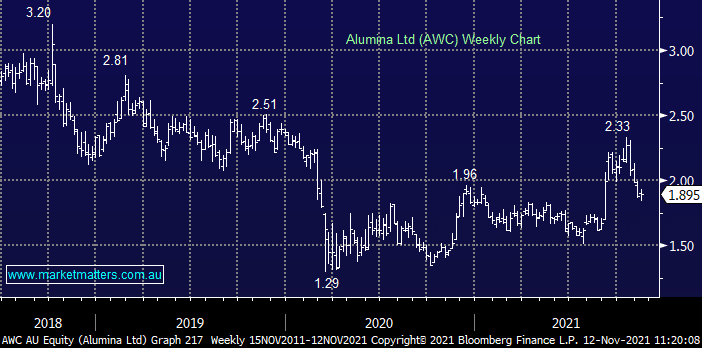

Alumina (AWC) – we took a relatively small 4% position here and in-line with our reflation view we are considering averaging into current weakness. Our thesis has not changed.

Capitol Health (CAJ) – we still like this position and again, our thesis has not changes hence why we remain happy to hold.