The Match Out: BHP underpins ASX strength as reporting heats up

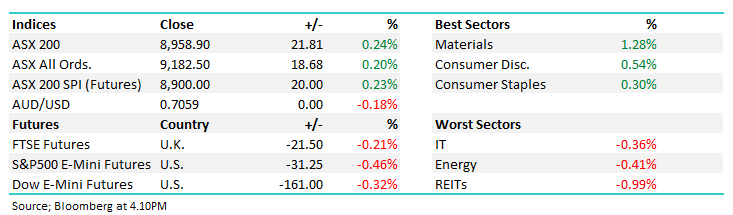

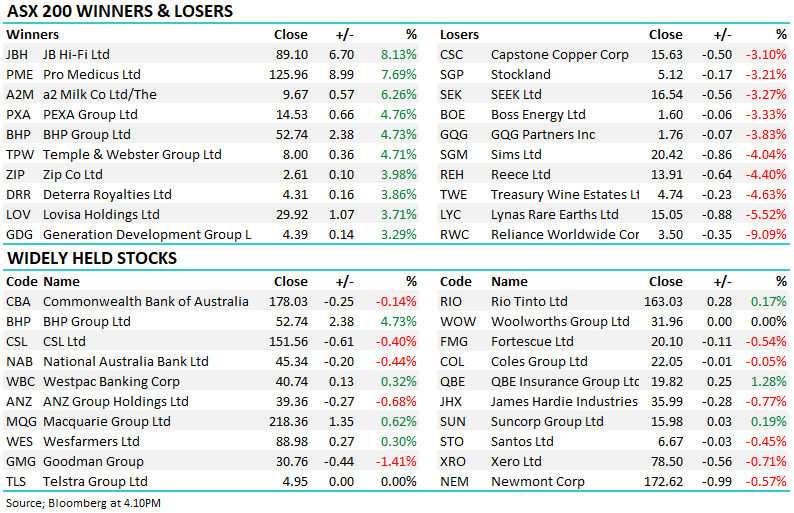

The ASX pushed higher in subdued trade, with BHP stealing the spotlight after a better-than-expected first-half result. Materials led the gains though it was all thanks the Big Australian’s performance, with weakness across the broader sector as commodities softened. Elsewhere, tech remained volatile, retailers were mixed and several reporting names were sharply repriced as the market continued its familiar reporting-season volatility.