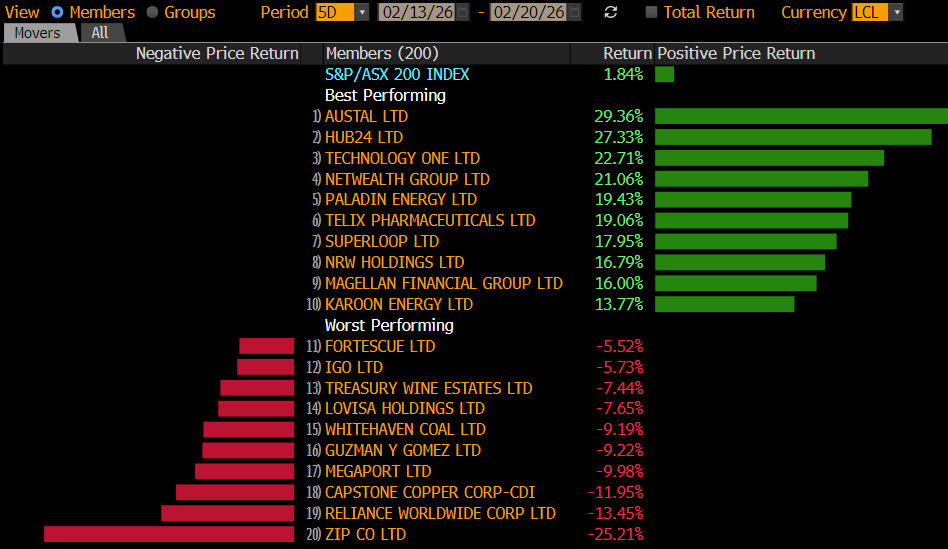

Local stocks got off to an encouraging start yesterday, with the index actually managing to edge higher early on ignoring the 800-point plunge by the Dow but things slowly but surely unwound throughout the day as aggressive selling hit the Resources Sector, perhaps some big players agree with MM that things have simply advanced too far too fast. Tuesday ultimately saw the ASX200 close down 0.8%, back under 7000, as profit taking appeared to roll through the energy stocks and miners while at the same time a number of the classic “risk off” areas such as healthcare…