Weekend Q&A: Markets hang around all-time highs as Trump’s tariffs are thrown into limbo

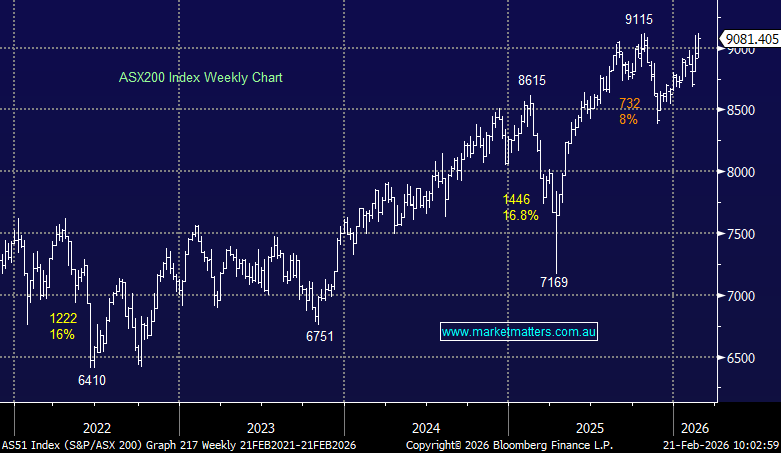

It was another bruising but ultimately constructive week for Australian equities, with the ASX200 finishing higher and holding close to all-time highs despite wild stock-level volatility as reporting season met the ongoing AI debate head-on. The index was again pulled in different directions under the surface, with sharp rotations between sectors and increasingly binary outcomes on earnings day. Strong results were rewarded aggressively, while any hint of disappointment was met with little mercy.