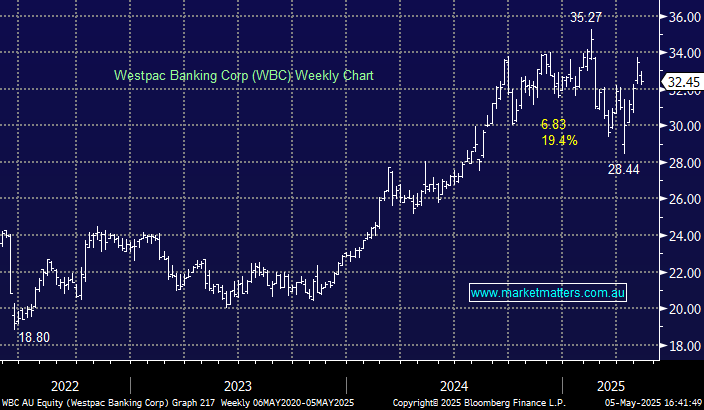

WBC –2.99%: The first of three ‘Big Four’ banks reporting 1H25 this week and while the result was mostly in line, the headline miss on profit and slight net interest margin contraction saw negative tremors flow through financials more broadly.

- Net profit after tax (NPAT) $3.3 billion vs $3.5bn consensus estimate

- Dividend per share of 76c vs 78cps consensus estimate

- Net interest margin decline 9bps to 1.88%

Capital stability was a highlight with Tier 1 ahead of consensus at 12.2% however softer margins and dividends ultimately weighed on sentiment today. CEO Anthony Miller has his work cut out for him though has a good foundation to build on – the focus will be on delivering the $3 billion ‘Unite’ technology upgrade while keeping costs in check (they were +3% during the period).

The stock ran hard into the result along with its peers with the market expecting a beat today. While there may be some short-term selling post-result, it’s now trading within a reasonable range of historical averages of 1.5x price-to-book and at 16.3x p/e so we remain comfortable holding it in the Active Growth Portfolio.