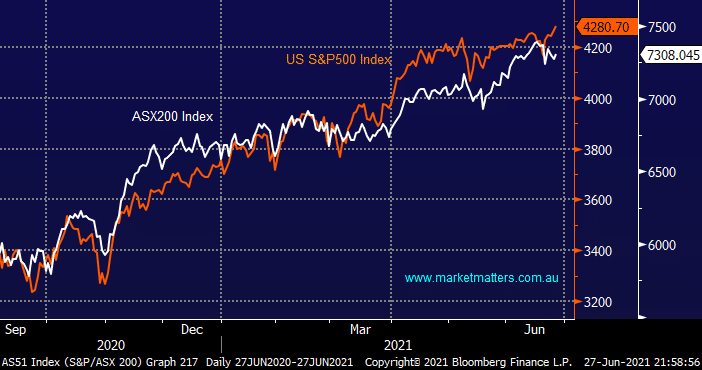

The US S&P500 had basically gone nowhere since April before last week when it again broke out to fresh all-time highs, conversely the ASX drifted last week and is set to test many investors nerves both this morning and through the week. If we see some panic by local stocks in the wake of the lockdowns MM will be looking to buy the “ASX200 & sell the US S&P500” for our Global Macro ETF Portfolio: Click here to view

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is a keen buyer of the ASX v the S&P500 if the spread widens by more than 5%

Add To Hit List

In these Portfolios

Related Q&A

September lows

How to use ETFs

Thoughts around the ASX200 range please

Is MM bullish the ASX200 Index?

Does the ASX200 look like a “Head & Shoulders” chart pattern to MM”?

Thoughts post a Christmas rally?

MM thoughts on BetaShares Geared Australian Equity Fund (GEAR)?

What are MM’s plans post Xmas?

Should I sell down my portfolio at current levels?

Thoughts on All Ords v Small Ords?

Is current market weakness a buying opportunity?

Buy the rumour and sell the fact!

Are equities bottoming?

Are we bullish or bearish the ASX 200?

What happens to the stock market after 4.00pm close?

How can MM assist me in building a portfolio?

ETF exposure for the long term

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.