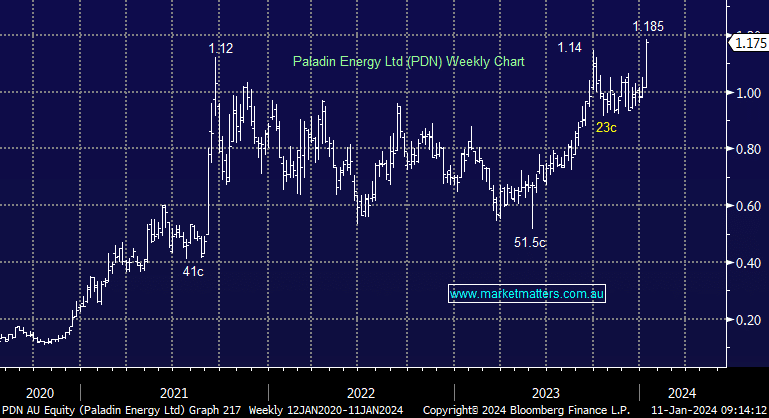

While we remain bullish Uranium, recent strength has provided the opportunity to take some profit and temper the overweight position in the Emerging Companies Portfolio. We are trimming Paladin (PDN) back from a 6% target weighting to a 4% target weighting.

NB: We also own PDN in the Active Growth Portfolio, with a 3% target weighting.

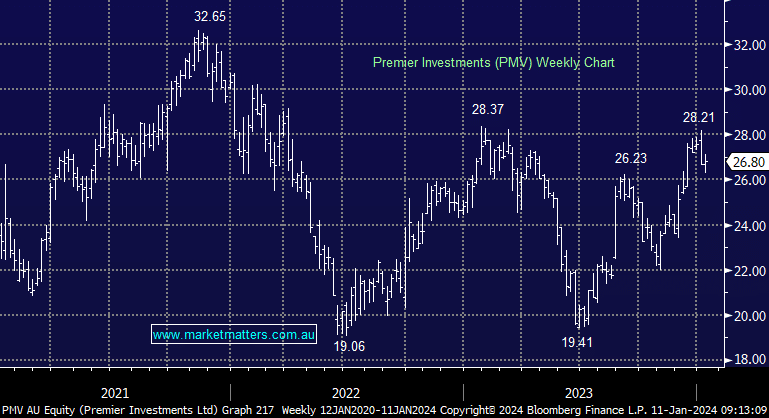

We are taking a profit on Premier Investments (PMV) as it trades near 12-month highs. We are more neutral Consumer Discretionary in the near term and see better opportunities elsewhere.

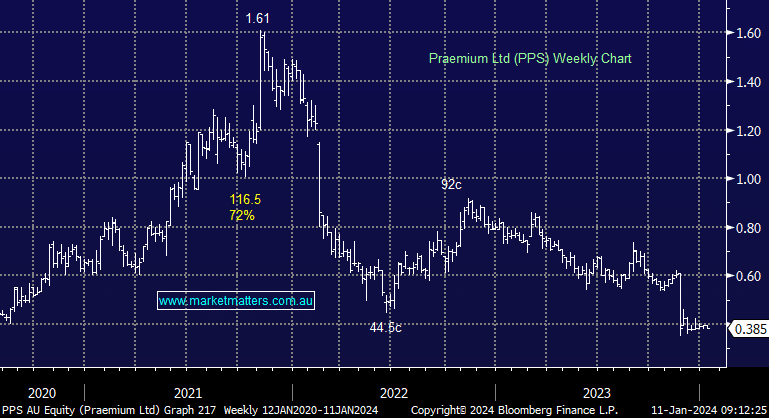

We are cutting Praemium (PPS) from the portfolio, a company that has struggled to grow earnings and a recent downgrade reduces our confidence in their ability to compete with the bigger players.

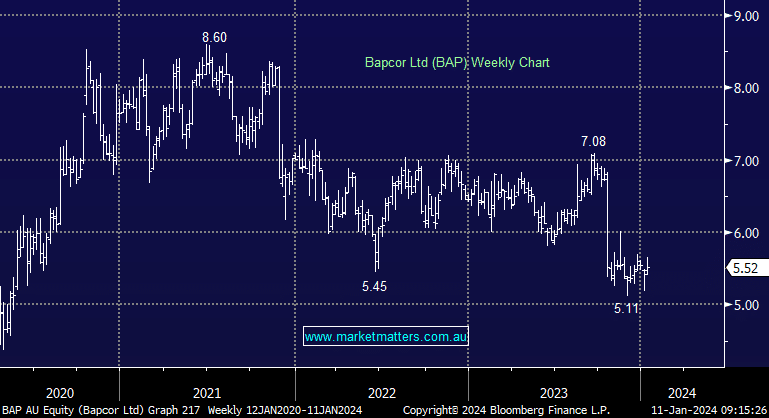

We are adding to Bapcor (BAP) with the view that falling interest rates and inflation will provide a tailwind in 2024. We are targeting a 5% weighting.