Telstra looks great both fundamentally and technically as we head into 2025. CEO Ms Brady has TLS looking at its more profitable companies, mobile phone plans, and InfraCo, which owns data centres—that phrase again! TLS is also very well-positioned to be a major beneficiary of the AI boom and is investing heavily in artificial intelligence (AI) as part of its broader digital transformation under its T25 strategy – lower rates give cheaper access to money for this investment.

TLS actively invests in multiple areas to drive its growth and enhance services. In FY25, its capital expenditure (Capex) is projected to be around $3.4bn; this includes funding for key initiatives like intercity fibre and Viasat infrastructure projects and $150 million allocated to Digicel Pacific. Telstra already carries over $10bn in long-term debt, which will be cheaper to service over time if/when rates fall, while its yield forecast to approach 5% ff by 2027 will remain attractive to yield-hungry investors.

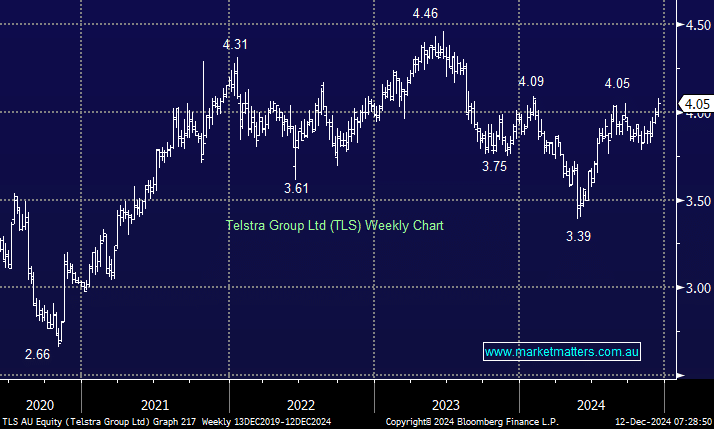

- We like TLS for its yield and hold it in our Active Income Portfolio – a break of $5 wouldn’t surprise in 2025/6.