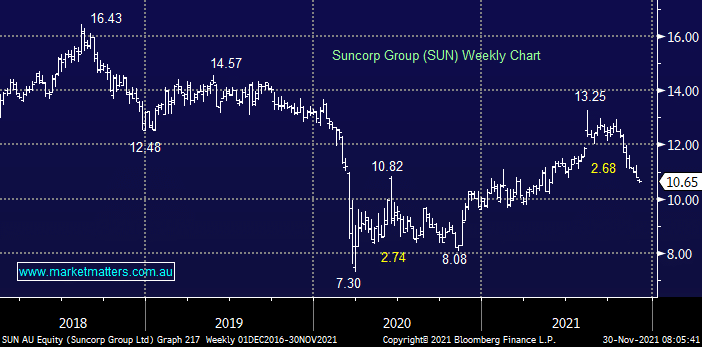

Queensland based banking / insurer SUN has now corrected over 20% from its August high while over the same period QBE Insurance (QBE) which we hold has fallen less than 9% as it simply consolidates gains. At this stage we still like QBE but when the banks come back into favour SUN is likely to offer better sector exposure – importantly we feel banks are rapidly approaching solid valuation levels.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Friday 11th July – Dow up +192pts, SPI up +27pts

Friday 11th July – Dow up +192pts, SPI up +27pts

Close

Close

MM will be tempted to switch from QBE to SUN if the later continues to underperform

Add To Hit List

Related Q&A

The Performance of Suncorp (SUN)

ANZ purchase of Suncorp

Thoughts on SUN

QBE

Q&A -weekend report – SUN

Q&A -weekend report – DRO & SUN

Correlation of bond prices/yields to the fortunes of QBE

Thoughts on Suncorp (SUN) please

ANZ’s Suncorp Take Over

Thoughts on the ANZ / SUN potential sale

Updated views on QBE given recent events

Thoughts on QBE & bank hybrids please

Dates on Suncorp divestment to ANZ please

Is this as good as it get for QBE Insurance (QBE)?

What is MM’s current view on Suncorp (SUN)?

Does MM like SUN after its strong rally?

What are MM’s thoughts on the ANZ – SUN tie up?

Banks & / or insurers as rates rise?

QBE

Semi Conductors

How do you get the yield on the SUNPI?

Thoughts on QBE

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Friday 11th July – Dow up +192pts, SPI up +27pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.