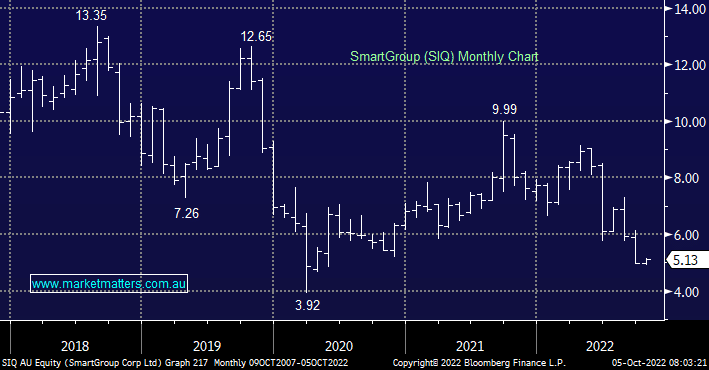

Salary packaging & leasing business Smart Group (SIQ) has had a very tough year with the stock down 30% since January, amplifying the weakness seen in the broader market. We owned Smart Group (SIQ) in the income portfolio previously having sold at $6.62 in early July, realising a ~15% profit at the time, however with the stock now languishing near 52-week lows, we again ponder whether or not it is back in value territory, after all, they did attract a private equity bid at $10.35 per share about 12 months ago. At the time of sale we wrote… Smart Group (SIQ) downgraded earnings expectations by ~8% a few weeks ago and also announced the loss of a major contract. We now see a company with few prospects to grow earnings (& thus dividends) in the coming 12 months that has risk around supply chains tightening again due to rising Covid cases. We simply see lower risk prospects for yield elsewhere, and can now get ~7% in a Hybrid with no earnings risk.

A lack of new vehicles and extended time frames (which resulted in the need for credit re-approvals) has been a major issue for SIQ this year while we’re now entering a period where sharply higher interest rates are negatively impacting consumer confidence and purchasing decisions. There are some positives here though with SIQ about to launch a digital vehicle sales portal to improve engagement while the cost of vehicles is going up which means bigger yields on leases written. While we still expect profit to be flat this year (December year-end), SIQ trade on 10x earnings with a projected yield of 7.2% fully franked. They carry very minimal debt and have a good balance sheet implying that dividends are sustainable from here.