The pandemic was not good for SSM with a slower roll out of NBN connections, complexity and cost around staffing plus they underwent a large ~$185m capital raise at 90c (SSM had a market cap of $400m at the time) to acquire Lendlease Services for $310m – clearly a lot going on under the hood of the infrastructure services business. Their upcoming 1H results scheduled for the 24th February will determine whether or not we remain patient or move on. The most important aspect of the result is around guidance, obviously for FY22 (market is expecting net profit of $36m from revenue of $1.3bn) but perhaps more importantly around the momentum building for FY23 which is where the numbers should really kick up pushing SSM down to just 9x earnings with a 5.75% fully franked dividend yield.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

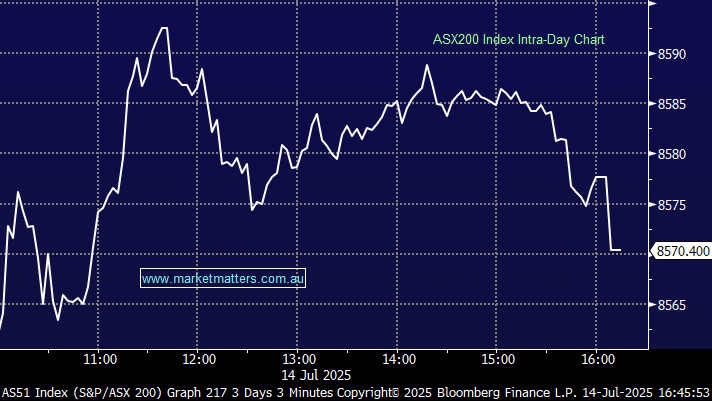

Monday 14th July – Dow down -279pts, SPI off -13pts

Monday 14th July – Dow down -279pts, SPI off -13pts

Close

Close

MM will assess SSM again post 1H22 results

Add To Hit List

Related Q&A

Resmed & Service Stream

Thoughts on SSM & SFR, please

Thoughts on Emeco (EHL) & Service Stream (SSM) please

What’s MM thoughts on SSM from here?

Is SSM the great dividend stock it would appear?

What is MM’s yield estimate for SSM?

What to do with Service Stream (SSM)?

Service Stream (SSM)

What to do with Service Stream (SSM)?

Service Stream (SSM)

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Monday 14th July – Dow down -279pts, SPI off -13pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.