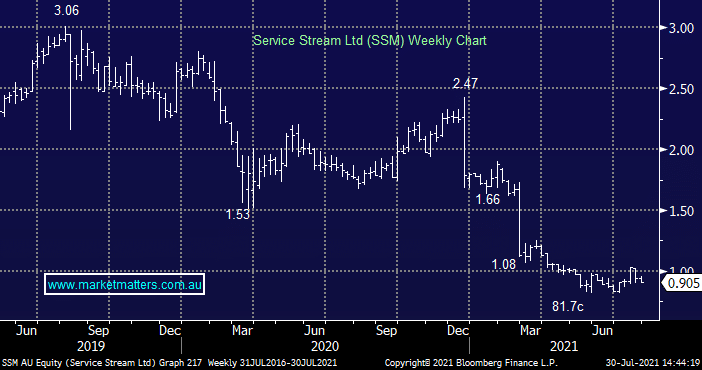

What to do with Service Stream (SSM)?

Hi James and Harry, Actually, two questions if I can? Firstly - Service Stream. Their non-renounceable retail share offer seems to me pretty skinny: circa 3% discount on today's (Tuesday) share price. They have made a good fist of destroying a lot of value for a lot of shareholders in the last little while: can we believe that they can make the Lendlease Services acquisition work? Will MM be taking up the offer? What is MM's view on SSM acquisition of Lend Lease’s services division and its Retail Entitlement offer? Does the offer seem a reasonable or speculative investment? – Ken D Hi James, I am really disappointed in ssm share price dropping to 90 cents on asx. SSM making out they are doing retail investors a favour, whereas i am starting to believe this is a con. I believe that the purchase of Lend Leases service business was to cover up bad management. Time will tell. Can u tell me if institutional investors were done any favors over and above retail investors, like with regard to dividends. Could you please comment on the SSM 1 for 3 share offer. Is it worth participating?