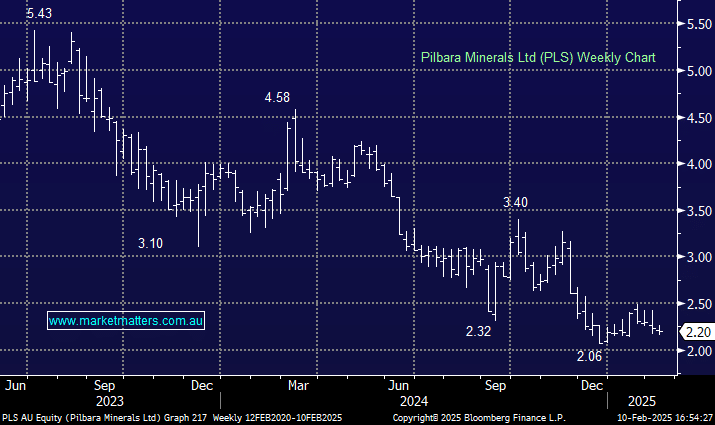

PLS -1.35%: dipped after providing a business update today, ahead of their 1H25 results, scheduled for 20th Feb. There were no major surprises, and the stock was down inline with the rest of the sector;

- The group expects to report a small underlying loss of $5-7 million for the half – no big deal, though there are a few things that will impact the statutory results, which will push that to a bigger loss of $68-71m

- Shawns’ Trading idea position was stopped out at $2.17 today after looking encouraging earlier this month.

Several brokers have tweaked their outlook on the Li producer over recent weeks. Goldman reinstated it as neutral, Bell Potter and Jefferies raised its target price, and Morgans cut its target to $2.55. The market remains mixed on PLS, with 1 Sell, 6 Holds, 8 Buys, and 1 Strong Buy. It all comes down to the price of Li, which we feel is “looking for a low” but perhaps is still not there.

We can see MM reconsidering PLS in 2025 as a trade or investment, but the sidelines feel good for now, with the underlying Li price struggling to get off the ground.