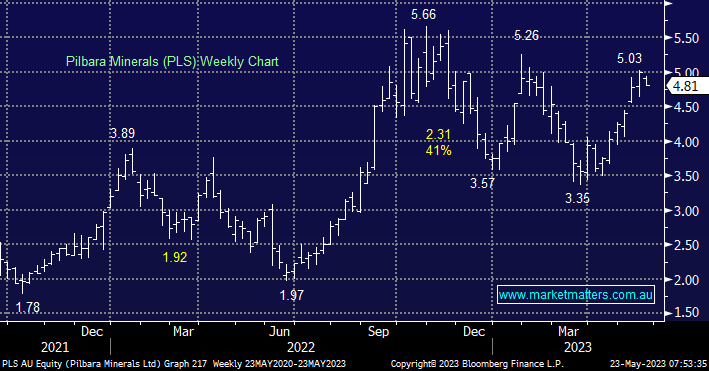

PLS has been MM’s recent stock of choice to take advantage of the lithium sectors strong recovery from its Q1 pullback, we regard ourselves as “Active Investors” with the major volatility in PLS necessitating a relatively small 3% position size within the Flagship Growth Portfolio – in under 18-months PLS has already corrected 49%, 37% and 36% hence subscribers shouldn’t be surprised if we hold this position a relatively short time after all history tells us we should get another good risk/reward entry opportunity.

We view PLS as the lower-risk exposure to this risky/volatile sector, growing production should underpin growing earnings and dividends. At their last update, they reconfirmed FY23 production guidance of 600-620kt, with margins for this early producer remaining solid. Their cash balance rose $457m in the quarter, pushing their bank balance up to a net cash position of ~$2.7bn which will support fully franked dividends.

- We can see PLS consolidating in the $4.50-$5 area following impressive recent gains with the risk/reward looking attractive ~$4.50 but ultimately we’re targeting a test of $6.