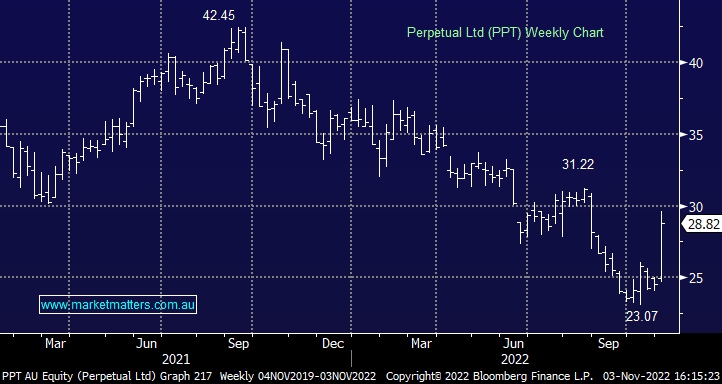

PPT +7.14%, PDL -10.67%, RPL +4.48%: Perpetual (PPT) has a bid in play for rival fund manager Pendal (PDL) and today it was announced that Regal Partners (RPL), alongside a Private Equity firm have made a bid for Perpetual (PPT) at $30, a small 11.5% premium to their last traded price. This is interesting as the ‘go too’ trade in town for hedge funds was short Perpetual (PPT) and long Pendal (PDL) as a way of getting a cheap entry into the combined entity – an arbitrage in other words – obviously assuming the deal completes. That led to the short position in PPT moving from around 1% of the register, up to around 11% making PPT the 6th most shorted stock on the exchange. The risk in that trade was a bid for Perpetual (PPT) scuttling the agreed takeover of Pendal (PDL) and right on cue, the market-savvy Phil King has done just that, making a bid for 100% of PPT via a $30 all cash per share offer.

While PPT’s board was quick to say the offer is uncertain & conditional etc, and significantly undervalues the group, which is hard to argue, the damage to those with big long positions in PDL offset by large shorts in PPT will be painful. Thinking more broadly about the deal, we suspect the bid would result in a break-up play with Perpetuals Trustee business either taken by the PE firm or spun out, with Regal taking on the fund management capability. However, the size of the deal is big for RPL which currently has~$5.5Bn in Assets under management and a current market cap of ~$680m compared to PPTs market cap of $1.5bn.