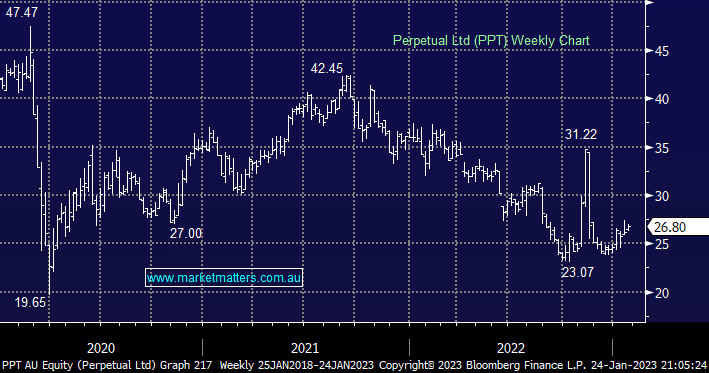

The big change in the portfolio this week was the scrip takeover of Pendal (PDL) which sees Perpetual enter the portfolio. After the acquisition, Perpetual now run $200b in assets alongside an attractive and stable Trust business. Perpetual announced further outflows from their funds over the December quarter, however, the bulk of the redemptions came from one investor and net flows were the lowest in more than a year giving hope their sales strategy is working. The upside will come from where they can successfully integrate Pendal and achieve the ~$60m p.a. in cost savings that made the acquisition so attractive. From a technical perspective, we are bullish PPT, however, from an income perspective we need to see evidence of synergies being realised and dividends flowing through to justify continuing to hold in the portfolio.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM is bullish and long PPT in the Income Portfolio

Add To Hit List

Related Q&A

Perpetual (PPT) and Magellan (MFG)

Perpetual Ltd (PPT)

Perpetual Ltd (PPT)

GARY stocks

Perpetual Limited

Your view on several stocks

Analysis of WHC, BHP, and PPT please

Your comments on some stocks please

Fund Managers

MM should be helping Magellan (MFG)!

Can you explain the PPT/PDL pricing please?

Thoughts now on PPT and PDL

Thoughts on PPL’s takeover of PDL?

Why is Pendal (PDL) falling after PPT’s bid?

Is it a good time to consider any of the fund manager companies?

What does MM think of Perpetual (PPT)?

Targets for PPT, CPU & CSL

MMs view on MOC & PPT

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.