Perpetual is a stock that shows two of the three qualities we look for in income holdings: defensive earnings and a solid dividend. The Trust business provides stability and the stock is yielding ~6% (unfranked for now), while the valuation sits at ~10.6x earnings, more than one standard deviation below its long-term average. However, the core of our interest lies in the latent value embedded in the franchise, which the market is currently overlooking.

This is not a new idea. Private equity players have circled PPT for years, most recently KKR, who bid $2.18bn for the Wealth Management and Corporate Trust businesses — a valuation that surprised us on the upside and validated the view that there is more worth inside PPT than today’s price implies. Ultimately, the ATO intervened, indicating a tax liability approaching $500m — well above Perpetual’s $106–227m expectation — and the deal fell over. Importantly, that doesn’t diminish the fact that KKR saw far more value in these assets than the market is currently pricing.

Management is now effectively pursuing the same strategy: simplify the business by divesting Wealth Management and focusing on Trust and Global Funds Management. This makes sense. The Trust business is low-growth but highly predictable, providing a stabiliser for the more volatile funds arm. Selling Wealth, even for a modest amount, would relieve some balance sheet pressure and allow the new leadership team, which has been refreshed from top to bottom, to refocus on execution. It’s worth noting that despite managing around $232bn in assets, the entire group today is valued at only ~$2.2bn equity plus ~$540m net debt – a disconnect that supports our view of mispriced value.

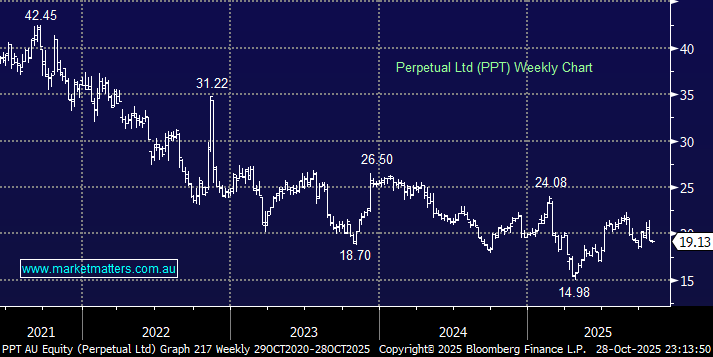

However, there are still reasons to be patient. Dividend franking won’t return until FY27 at the earliest, fund outflows continue to cap sentiment, and we haven’t yet seen clear operating leverage in the funds business. We’ve held PPT before in the Income Portfolio, selling above $25 in mid-2023 to rotate into MFG at $8.60, with PPT down a bit and MFG up a bit, but nothing material for either, reminding us that timing matters in this sector more than most.

- There’s value here, but we don’t need to rush. With exposure already in the space via GQG, we’re adding it to the Hitlist, but not taking action for now. If selling pressure takes PPT below $17 — that’s where the risk/reward skews in our favour, and where the upside from simplification becomes more compelling.