NRW is a leading Australian mining and civil contracting group that provides services across the resources, infrastructure, and energy sectors. The company has a diversified client base (including BHP, Rio Tinto, and Fortescue), a strong order book exceeding several billion dollars, and a reputation for delivering large-scale projects efficiently. Its performance is closely tied to mining investment cycles, but its breadth of operations provides some resilience against commodity price swings. On Monday, it rose the most in 9 weeks following MND’s upgrade boosted the space. In October NWH had upgraded earnings and revenue as activity levels increased in early FY26, and it completed the acquisition of Fredon Industries.

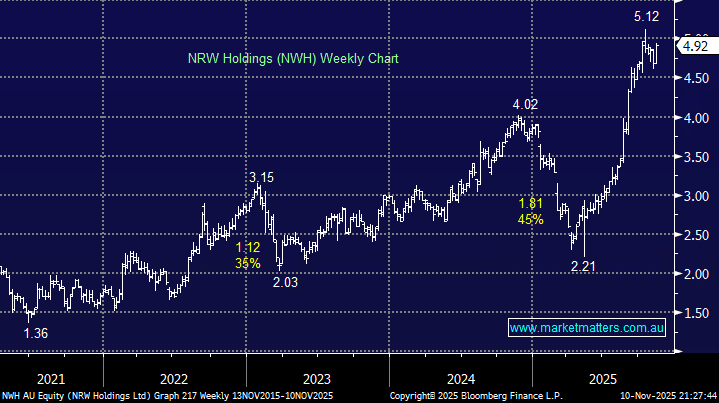

- The starting point for NWH’s rally came from a more depressed level following customer OneSteel appointing administrators at Whyalla Steelworks, forcing NWH to take a $113m impairment provision, pushing shares sharply lower at the time.

While NWH is on the expensive side relative to its own history, on an Est PE of 13.5x for FY26, it’s still screens relatively cheap against an expensive market. There are reasons why these sorts of businesses trade on the cheaper side, but if we do continue to see significant spend across mining and infrastructure, NWH is very well positioned to continue to benefit from it.

- We can see NWH consolidating recent gains between $4.50 and $5.50 into 2026, growing into its more elevated valuation.