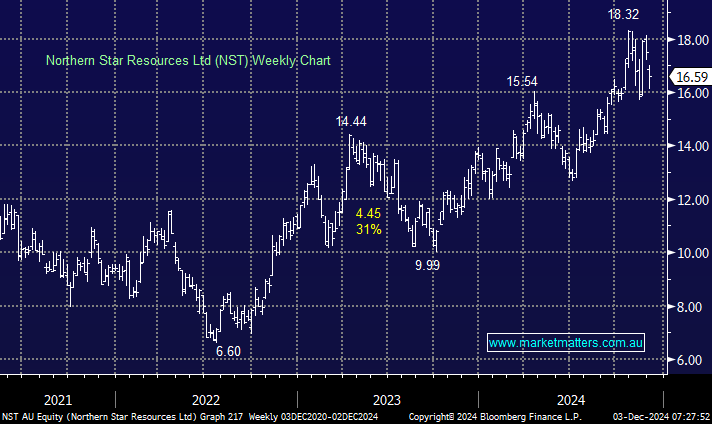

We like the deal announced yesterday for NST, enhancing NST’s production potential while addressing ageing asset concerns. NST is set to secure a key asset in the Hemi gold project in W.A., one of Australia’s largest undeveloped gold mines. NST is positioning to increase annual production to 2.5mn oz by 2029 with the deal; yesterday’s knee-jerk -5.3% drop suggests that some think they overpaid; we disagree as assets are likely to increase in price as M&A is expected to increase across the space.

In our opinion, NST has been wise to “go early” as the competition for assets will likely intensify in 2025 and they have the expertise and capital (a whopping $1.3bn) to get the Hemi project up and firing. Note, De Grey’s asset is probably going to be 20 million ounces of gold by the time they’ve finished drilling!

- While we remain bullish toward gold, NST is an excellent large ASX proxy enhanced by its acquisition of DEG.