This week’s quarterly report from NST didn’t excited investors as much as EVN’s, with a mixture of reactions from brokers. NST said its all-in costs (AIC) were A$3,278/oz in the December quarter, higher than a year ago due to capital growth projects, led by the KCGM Mill Expansion Project. The company has positioned itself for the future having bought De Grey Mining (DEG) for $5bn, a move that should pay dividends if our long term outlook for gold proves on point.

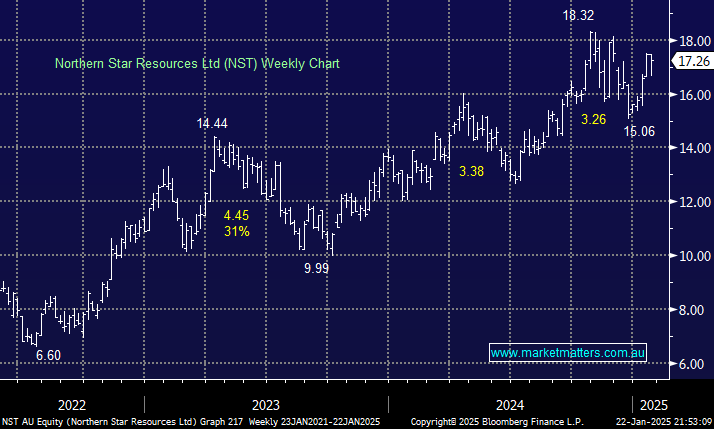

- We like NST targeting the $19-20 region in 2025.