NST is a pure gold play that has, at times, been a major out-and-under performer within the gold space. Analysts and investors are cautious about their FY25 production expectations, but the company’s $300 million on-market share buyback, which is 57% complete, should support any dips in the share price. NST estimates its annual cash earnings for 2023-24 will be between $1.78 billion and $1.82 billion, nearly 50% above the previous year, aided by an extremely strong gold price, especially in $A terms.

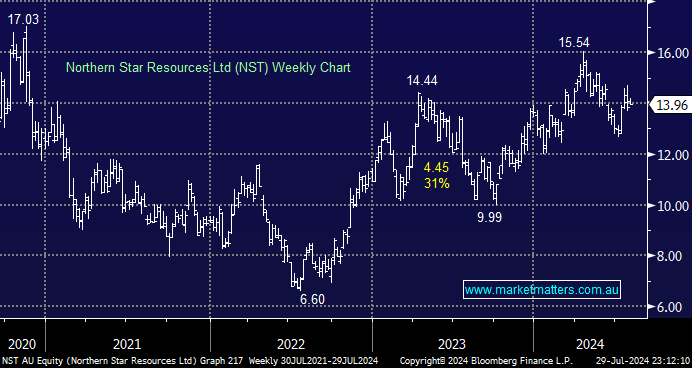

- We like the risk/reward on NST around the $14 area.