Yesterday, CBA announced the issuance of a new Hybrid Security, the PERLS 16 which is a completely new money offer, meaning they are not rolling an existing security. It is a typical Tier 1 Bank Hybrid, the same in structure as recent CBA (and other major bank) Hybrids. We believe this is a solid security and attractive relative to other hybrids.

- The $750m offer comprises a new money offer only (with applications to be made through a Syndicate Broker). This means that only clients of brokers that are part of the deal can apply.

- The margin range will be between 3.00% and 3.20% pa above the 90-day bank bill rate which is 3.91%. Expect the margin to land at 3.00%, not 3.20%, noting this includes the benefit of franking. Demand for the book has been high so far.

- As usual, the quarterly distributions are discretionary and subject to the distribution payment conditions being met. There are a few things in this, however for CBA to stock paying distributions on the hybrids, they could not pay dividends on the shares.

- First call date is 17 June 2030, (approximately 7 years).

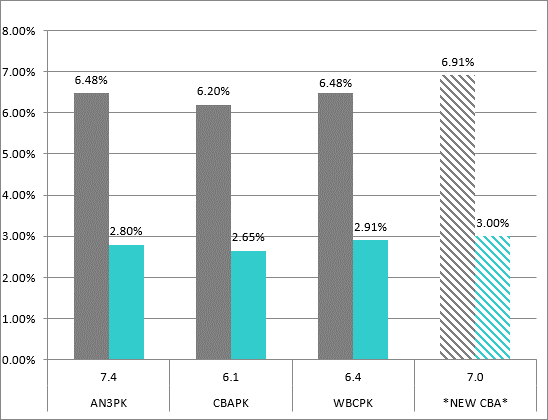

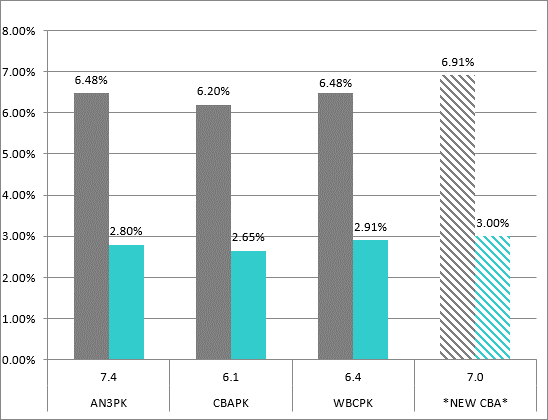

If the margin lands at 3.00%, as we expect it will, this is around 0.15% – 0.20% better than existing major bank Hybrids with the same duration, while CBA is also seen to be a higher-quality issuer. In terms of margins for new issues, there should be a premium to compensate for the lag between launch and listing and the risk this can pose. That said, most recent new issues have not done so (ANZPK, CBAPL & WBCPL) recent examples that had very little or no ‘fat’ in them.

The most recent comparable issue was the ANZPK which was priced with a margin of 2.75% and now trades on a margin of 2.80%.