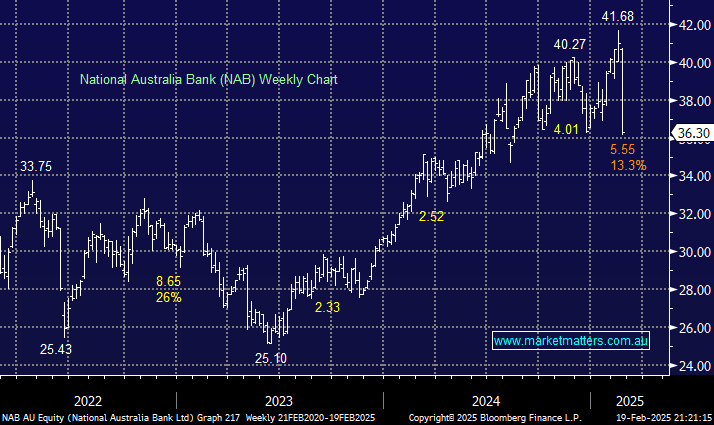

NAB was clobbered over 8% on Wednesday on what appeared only to be a slight miss at their quarterly trading update, but as we’ve touched on earlier, that’s not good enough when the stock price is up over 60% in just 18 months. The market appeared to focus on the impact of CBA pushing hard into business banking, increasing the risk factor for NAB, with the incumbent appearing to be more aggressive in defending market share, which is set to have a detrimental impact on margins – a concern we’ve highlighted in reports over the last few months.

- We will consider NAB back in the $34 region, or ~6% lower.