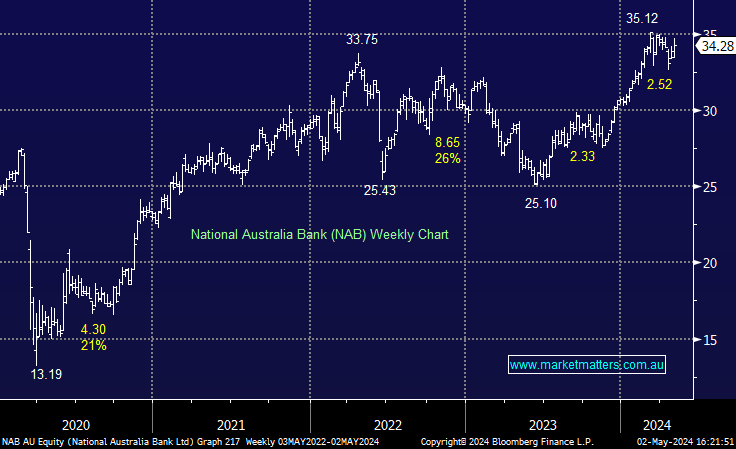

NAB +1.45%: The first bank to release 1H24 results today provides a good insight into the broader sector. NAB’s 1H24 cash profit was $3.55bn, inline with consensus while Net Interest Margins (NIM) came in ahead of expectation at 1.72%. Costs in line and Bad Debts remained subdued, and better than hoped.

The dividend of $0.84 was 1c ahead of consensus while they also announced a $1.5bn top up of their buyback. Some in the market were talking about this as a possibility /probability but still an unknown so waken as a positive surprise.

Margins have been in focus and it looks like they’ve stayed stable QoQ and are up from this time last year as both mortgage and deposit competition moderate. Costs rose 1.6% for the half to $4.68bn, in line with expectations, impacted by wage increase and tech investments but partly offset by ongoing cost-out benefits.

- Overall, a broadly in-line to slightly better than expected result, with NAB continuing to manage well vs expectations.