MIN +9.19%: Struck an important deal bringing much needed cash in the door to reduce debt, agreeing to sell 30% of its operational lithium business to South Korea’s POSCO Holdings for US$765m (A$1.2b) in cash. This looks good on a few fronts:

- It brings in cash to pay down debt – combined with a recent $200m payment for the Haul Road, the additional $1.4bn should bring debt to EBITDA down to ~3x, which could lead to credit rating upgrades.

- Implies a higher valuation for MINs 50% stake in Mt Marion and Wodgina than the market thought.

- POSCO is a serious strategic partner.

The deal will see a new joint venture created, holding MIN’s existing 50% stakes in both the Wodgina and Mt Marion lithium mines — two of Australia’s best-known hard-rock assets. The transaction effectively values MIN’s 50% share in the two projects at around A$3.9b, with the company retaining a 70% interest in the new JV.

POSCO will receive spodumene concentrate equal to its 30% stake, while MIN continues to operate both mines under existing arrangements with Albemarle (Wodgina) and Ganfeng Lithium (Mt Marion). Completion is expected in the first half of 2026.

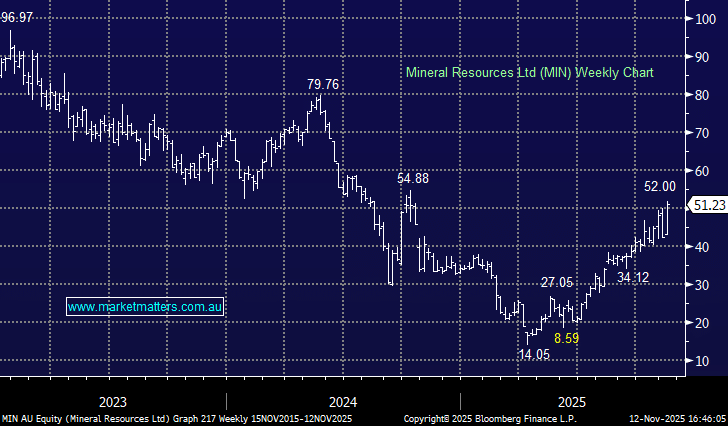

We see this as a sensible and confidence-building step for MIN. It won’t magically fix the lithium market, but it shores up the balance sheet, validates asset value, and keeps MIN in the driver’s seat operationally.

We continue to view MIN as a high-beta, long-term lithium-iron ore hybrid — volatile, yes, but with genuine optionality when the lithium cycle turns.