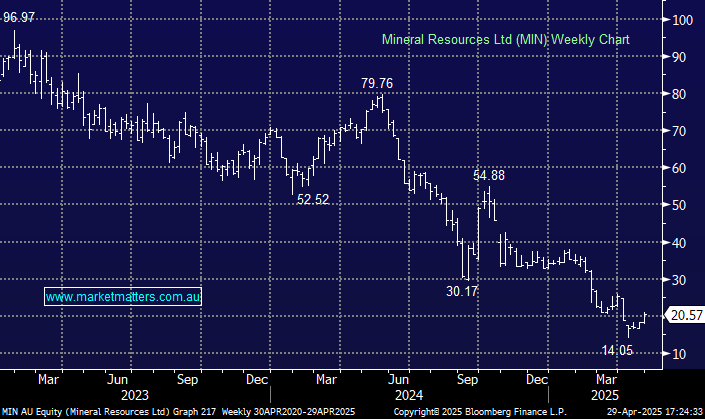

MIN +13.15%: Jumped on their 3rd quarter result on softer production numbers though reiterated full-year guidance and provided comfort around the balance sheet, progression of the search for a new and improved board and an update eon reparations of the key Onslow Iron haul road asset.

- Total iron ore shipments 4.46 million wmt, -15% q/q

- Mining services volumes 62 million tons, -8.8% q/q

- Spodumene concentrate shipments 127,000 dmt, -11% q/q

- Liquidity at March 31 in excess of A$1.25 billion

Encouragingly, volume guidance was upgraded at Mt Marion with cost-guidance maintained. Outside of the production numbers, management comforted key market concerns, confirming the process to appoint a new Board Chair Chris Ellison is well advanced and on track to conclude in the June quarter. Given strong liquidity and a number of other levers disposal, an equity raise is not under consideration by management at this stage. Finally, pleasingly the upgrade of Onslow Iron Haul road remains on schedule for completion by September (1Q FY26) which will be a key milestone for regaining market confidence.