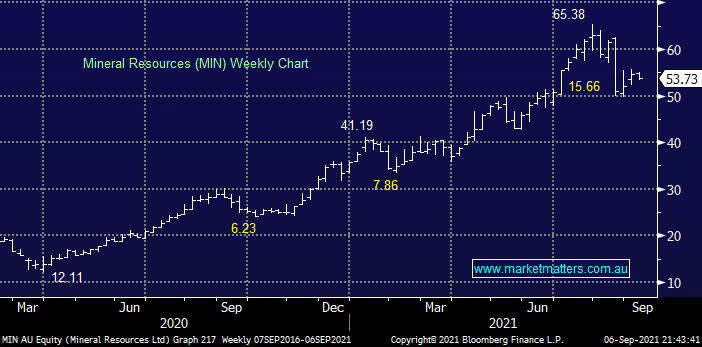

MIN has underperformed PLS over recent months which is no surprise considering the plunge in iron ore, the primary component of the company’s current revenue flow. We believe the sale of PLS is logical for this $10bn company but as the iron ore outlook clouds an extension of its 24% pullback wouldn’t surprise i.e. we like the idea of slowly accumulating MIN into any further weakness.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM is currently neutral / positive MIN

Add To Hit List

In these Portfolios

Related Q&A

Mineral Resources Ltd (MIN)

The taking a loss lottery

Where would you buy Mineral Resources (MIN)

Views on MIN, AGL, & IPL

Is it time to buy the fall in quality mining stocks &/or GQG following their latest FUM nos

Thoughts on Mineral Resources (MIN)

When do you give up on Min Res?

Mineral Resources

MIN, MP1

Energy & mining stocks

Dollar cost averaging

MIN / IPG

Resource stocks are a hard call at times!!

MIN – Compelling buy?

Update on FCL, FSLR, SLX and some lithium stocks

PLS: a buy at these levels?

Allkem thoughts on risk/reward below $9.50

Iron Ore Producers

Does MM like Lithium and its respective stocks?

MIN US bond issue at 9.25%, can I get some?

Thought on MIN’s 14% Stake in Delta Lithium (DLI)

What are MM’s top picks for resources exposure?

When does MM decide to sell?

Could Mineral Resources (MIN) demerge moving forward?

JIN & MIN – part 2

MIN

Thoughts on Lithium & Gold

Our view on Mineral Resources (MIN)

Strandline (STA) capital raise & Mineral Resources (MIN)

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.