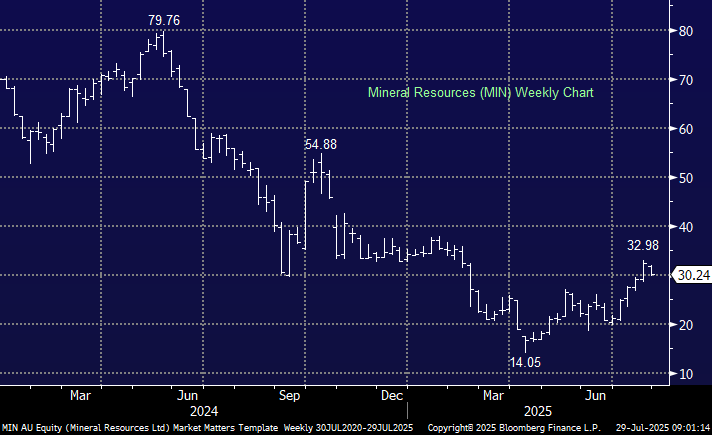

MIN has benefitted from the significant bounced in iron ore and lithium in recent weeks pushing the stock up ~100% from its April low, though a pullback in both areas weighed in MIN yesterday – it’s a volatile beast at present. Further downside in the coming days would not surprise but we like the risk/reward back around the $27-8 region, a similar drop to yesterday’s move, and we’re basically there! Again, with a greater than 13% short position, there remains room for a further squeeze on the upside.

After close yesterday, MIN disclosed that Resource Development Group (RDG), of which MIN owns 64.3% has entered voluntary administration. Not good news, and MIN will take a non-cash impairment, however, RDG was small, with the stake worth ~$16m marked to market, and MIN recently determined nor provide them financing. We don’t believe this will have a significant impact on MIN.

- We continue to believe MIN can initially retest the $35-40 area: MM is long MIN in our Active Growth Portfolio.