Microsoft delivered another strong quarterly result, with revenue and earnings beating forecasts across the board, though the market reaction was muted as expectations for its AI and cloud business remain sky-high. Shares were trading down ~2.6% in after-hours trade, despite an impressive set of numbers.

- Revenue: US$77.67bn vs est. US$75.55bn (+17% YoY constant currency)

- Earnings: US$3.72/share vs est. US$3.63

- Operating income: US$37.96bn vs est. US$35.1bn

Breaking up the composition of the result last night highlights the diversity of their business, and underscores why we continue to believe MSFT is a must-own AI-related stock, that we think will be a natural winner in this evolution, without the risk of backing more concentrated platforms.

- Intelligent Cloud: US$30.9bn vs est. US$30.2bn

- Azure & Other Cloud Services: +39% YoY (ex-FX), slightly above consensus but flat vs last quarter.

- Productivity & Business Processes: US$33.0bn vs est. US$32.3bn

- More Personal Computing: US$13.8bn vs est. US$12.9bn

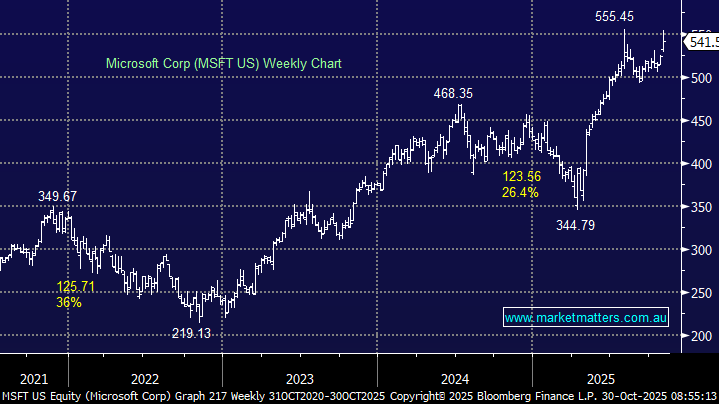

Microsoft continues to execute exceptionally well, with Azure maintaining near-40% growth and margins holding up despite heavy AI investment. They did increase capex guidance, a common theme, showing just how fast the AI infrastructure race is accelerating. The slight weakness in the shares post result is more about positioning and expectations. We own MSFT US in the International Equities Portfolio.