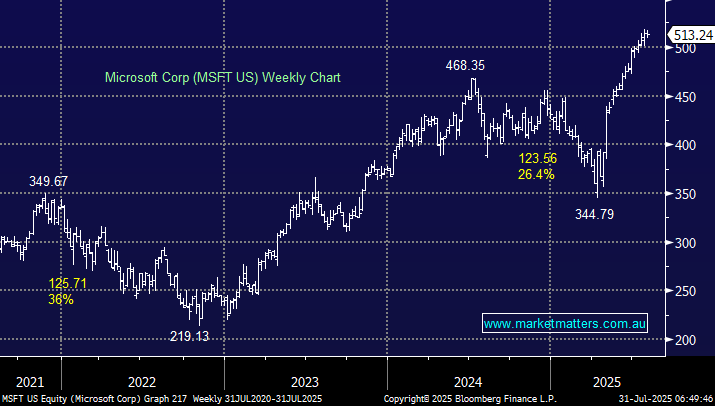

A great result released after market by MFST with a quarterly beat and bump up in guidance pushing shares 9% higher in afterhours trade, the company continues to commercialise AI. Microsoft’s revenue growth accelerated to 18% in the three months ending in June, driven by stronger-than-expected sales in its Azure cloud computing unit. Revenue in Azure grew 39%, a significantly higher rate than the roughly 34-35% growth the company had forecast, and faster than its 33% growth in the prior quarter. The stock initially surged ~7% in after-hours trading sending its market cap up towards $4 trillion.

- 2Q revenue of $US76.4 bn was +18% YoY, beating estimates of $US73.9bn.

- 2Q EPS of $US3.65, which beat estimates of $US3.37.

- Capex came in at $24.2bn, up from $US21.4bn in the previous quarter.

This is another great result for MSFT, which is already seeing returns on its AI spend

- We remain bullish MSFT which remains a core holding for us: MM holds MSFT in the International Equities Portfolio.