Macquarie’s 3Q25 operational update was reasonably well received on Tuesday, with the stock closing up +1.6%, less than 5% below last month’s all-time high. This is a business with revenue from several areas, and while the quarter was soft in some analyst’s eyes, MQG said the short-term outlook remains “materially unchanged”:

- Macquarie Asset Management (MAM): Base fees are expected to be broadly in line, and net other operating income is expected to increase significantly.

- Banking and Financial Services (BFS): The company continues to see growth in its loan portfolio and deposits, although margin pressure partially offsets this.

- Macquarie Capital (MacCap): Transaction activity is expected to increase from a low base. Private credit portfolios and asset realisations are expected to support investment-related income.

- Commodities and Global Markets (CGM): Commodities income is expected to decrease, but volatility may create opportunities.

We like that the annuity-style businesses (MAM & BFS) improved up (15-25%) on the previous corresponding period (PCP), mainly due to higher performance fees and Investment Income in MAM and volume growth in BFS. Market-facing businesses (CGM & Mac Cap) endured a tough quarter, down a similar 15-25% on PCP, which affords some hope of an improving backdrop in today’s volatile “Trump” world. Overall, the composition of earnings improved even though the aggregate of them did not.

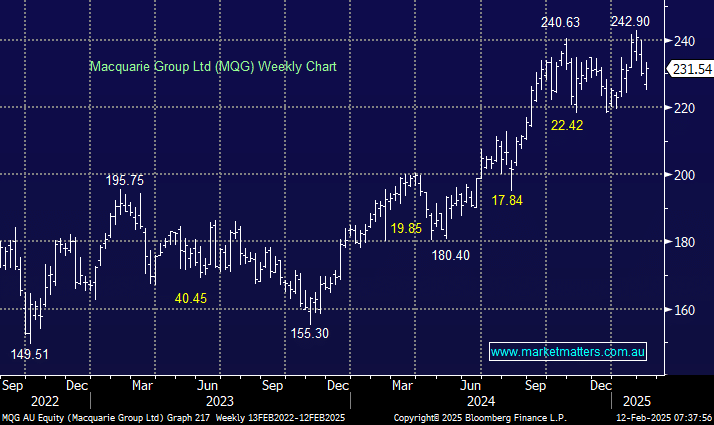

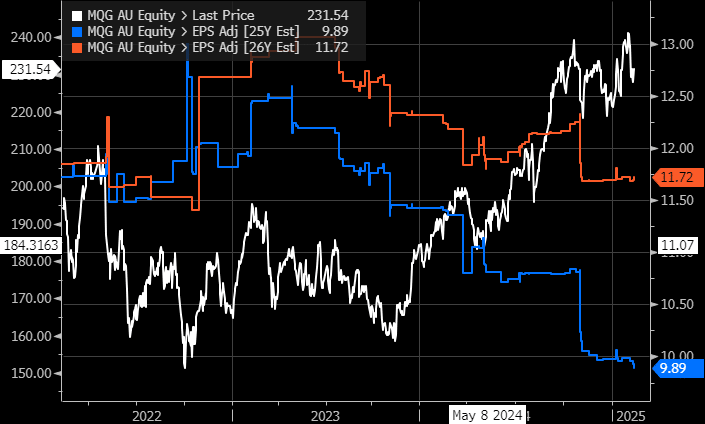

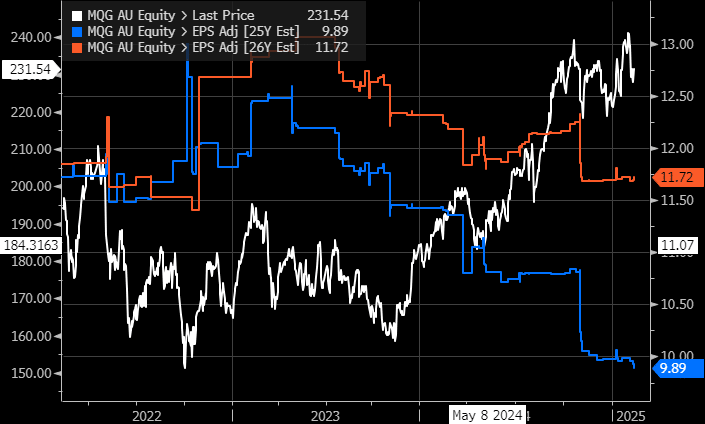

Analysts have cut their Macquarie earnings estimates at the past seven quarterly updates, but the “Millionaires Factory” continues to rally with valuation expansion driving much of the gains, as it has across the “Big Four Banks”. MQG is trading more than +1 std deviation above its long-term average and a price-to-book value of 2.5x, again above +1 std deviation; not as rich as, say, CBA, but it’s still on the expensive side of the ledger. However, MQG made nearly half its profit in commodities last year, and when we look at other global companies with a commodities trading-driven earnings stream, it’s arguably even more expensive.

- Earnings forecasts will need to turn higher for MQG’s share price to make a further assault above $250.

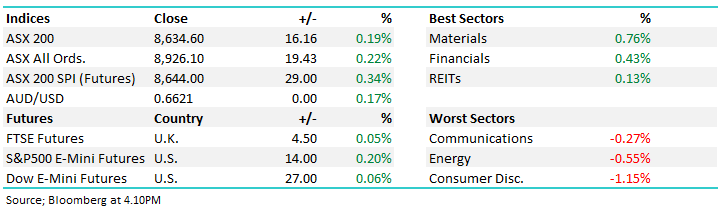

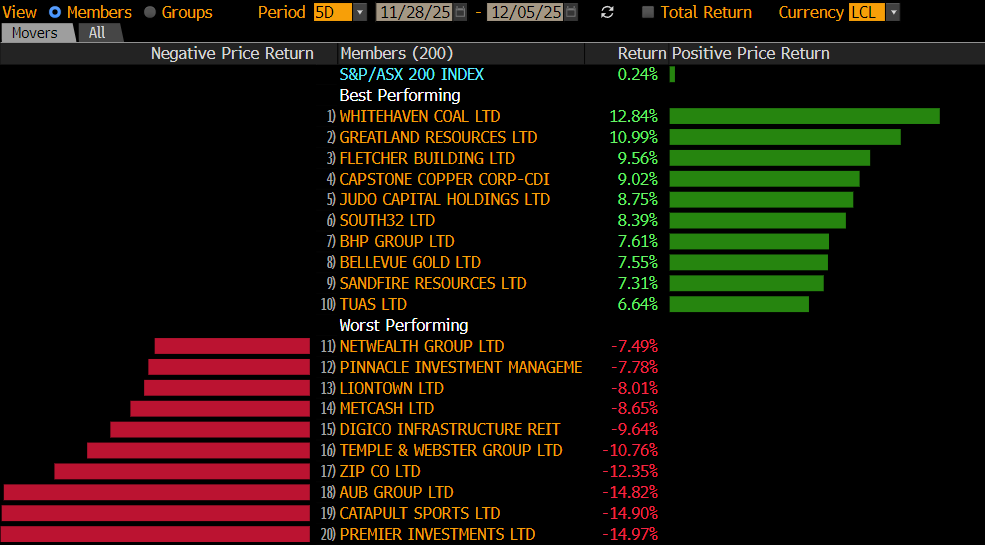

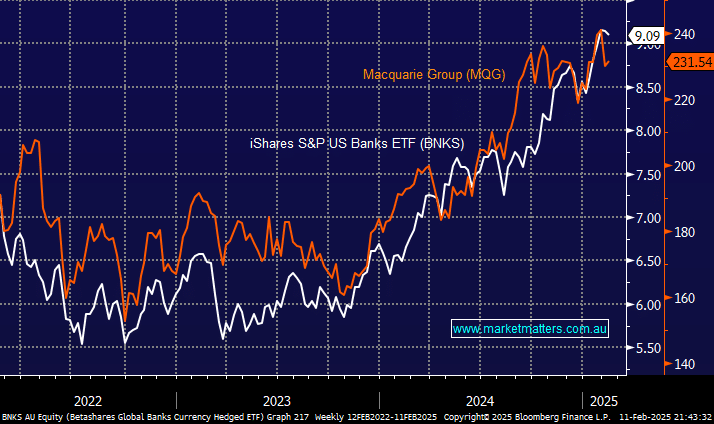

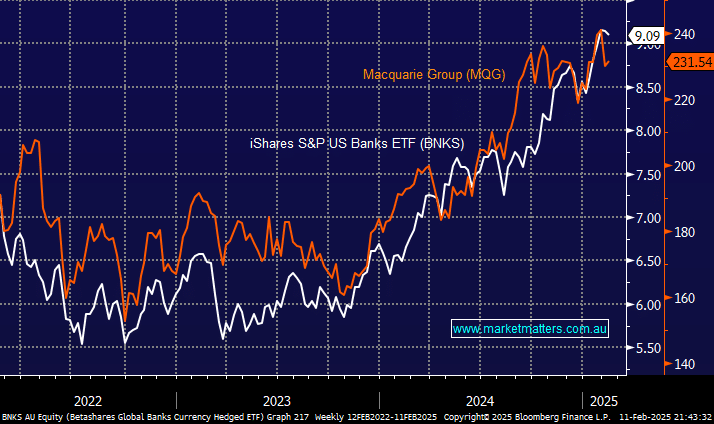

The correlation between MQG and US banks is extremely tight. According to Bank of America, some funds are rotating out of the high-flying US tech sector into the banks, suggesting support for the group and, by association, MQG. As we’ve discussed previously, the US sector has a Trump tailwind at its back courtesy of rates, regulations, and rebounding customer activity, but it has already run hard from its 2023 lows.

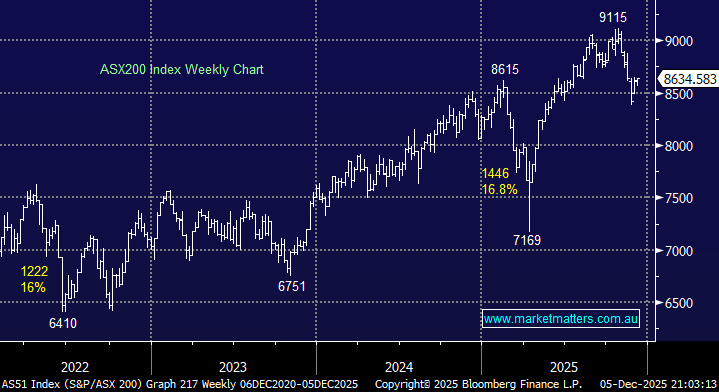

- Selling the banks on valuation concerns in 2024 was a painful experience, but getting excited around the group at current levels remains hard.

From a portfolio perspective, we are already underweight the banks, holding just 6% in ANZ and 4% in MQG; hence, if we sold our MQG position, we’d be looking for an alternative in the sector. From a valuation perspective, a switch makes no sense; they are all expensive! However, there is a yield differential; MQG is forecast to yield 2.9% part-franked over the coming year compared to, say, Westpac’s (WBC) 4.7% fully franked. We can see the banks consolidating their stellar gains in 2025 with better returns likely to be generated from the higher-yielding names, such as ANZ, which we already hold. We are not ruling out legging a switch out of MQG, in line with our two-step forward and one-back outlook for the market.

- We can see MQG rotating in the $220-$250 area through 2025; MM hold MQG in our Active Growth Portfolio.