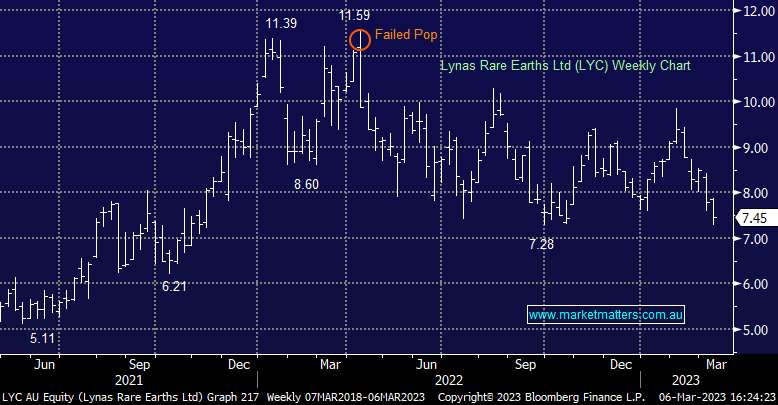

LYC -4.49%: slipped to a 4-month low today before recovering somewhat, though it is still down 14% over the past 3 months. The recent weakness largely stems from Tesla (TLSA) announcing they were working on replacing the rare earth materials in their EVs to reduce costs. While they are committed to the comment, it was hard to pinpoint the technology required to replace the rare earth materials used within the engine. Additionally, EVs are just one application of Lynas’ products which are vital in a range of applications in clean energy generation & distribution, while Tesla is just one EV manufacturer. There is a very broad range of analyst price targets in the market for Lynas at the moment, ranging from a sell at $6.70 and the highest buy at $12.78. We think the sell-off has been overdone on fears the company’s Kalgoorlie plant ramp-up will take longer than expected with Lynas managing inventory well to limit any downside in the event there is a production gap come 1 July when their Malaysian licence conditions change.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM is Bullish LYC, looking to add to our 4% weighting in the Emerging Companies Portfolio

Add To Hit List

Related Q&A

Has the market forgotten Lynas (LYC)?

Is Lynas (LYC) a falling knife?

Your view on several stocks

Is Lynas (LYC) a bargain?

Does MM prefer Lynas or Iluka?

Your comments on some stocks please

What are MM’s current View on Lynas (LYC)?

Why did Lynas (LYC) get crunched this week?

What’s MM’s current view on LYC?

Does MM still like the coal price and coal stocks?

Does MM prefer Iluka (ILU) over LYC &/or STA?

Lynas and PLS

Stocks to lighten as I increase cash

Hold or sell Lynas (LYC)?

Greenland & Rare Earths

MM’s view on LYC

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.