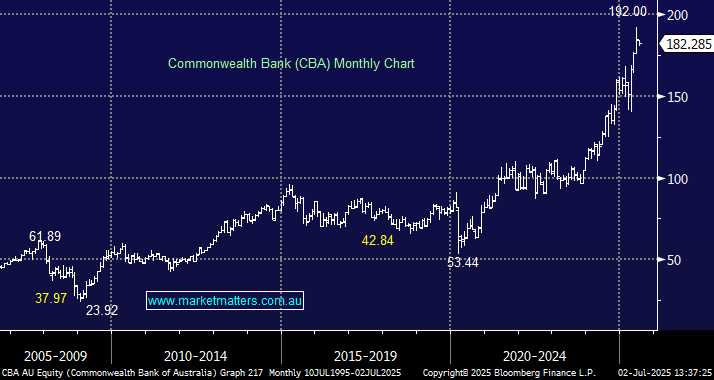

GMG slipped over 2% on Monday when half the Real Estate Sector managed to advance. This is a quality business; the question we have asked ourselves of late is how far it can rally. Last week, we trimmed our holding around $35.50, but every time it feels vulnerable to a meaningful correction, it punches higher, just as it did last week. Major brokers have been downgrading the stock over recent weeks, but these same houses turned bearish CBA a long time ago, which has proven to be a painful journey. GMG is a stock that we are keen to upweight again into dips, and while reducing into strong gains has a foundation, we don’t want to lose our position.

- We would look to increase our GMG position back around $30 if it got there. MM is long GMG in our Active Growth Portfolio.