GMG shares reacted positively to their result in August, which revealed a 16% jump in earnings per share (EPS), which was slightly ahead of guidance plus the company expect another 9% gain in FY24. However, arguably the biggest lift for the stock came from comments about the future direction of the business, the company announced that data centres are set to be the next step in its evolution – which sounds exciting when we consider that NEXTDC (NXT) has rallied ~50% from its 2022 low to become a $6.4bn goliath in the space. Well-respected CEO Greg Goodman said they had access to the sites, including the ability to repurpose existing properties, and it’s already started getting its hands on power and customers.

- GMG has a similar “look and feel” to Altium (ALU), which we bought last week, i.e. the company pleased the market when it reported back in August, but the stock has corrected in line with a weak market through September.

There was nothing in the numbers that MM didn’t like, with total assets under management now worth over $80bn, up 11% from FY22, making the stock many people’s first choice in the Property Sector – no major change here. While the stock never screens cheap compared to its peers, we believe the business’s quality and future now justify the price, i.e. it has consistently delivered high rates of return with relatively low levels of leverage. We like that GMG is an active real estate manager who can grow their assets under management and add value through buying and building different assets and managing the strategy once those assets are complete. Lastly, real estate stocks are sensitive to interest rates, but GMG will be a beneficiary of lower bond yields, assuming our macro call proves correct.

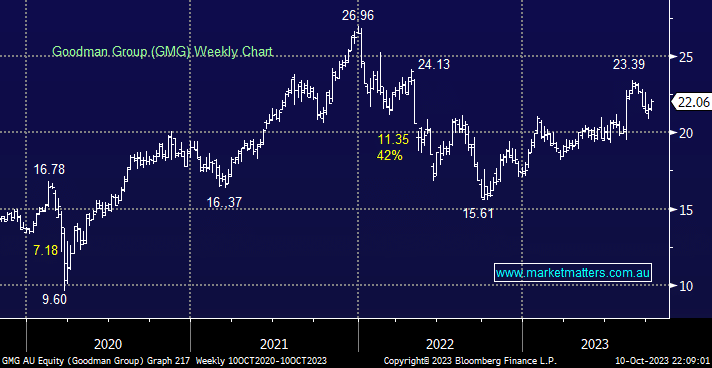

- We sold GMG too early back in August, however, we now have it back on the radar with an initial target above $24, or 10% higher.