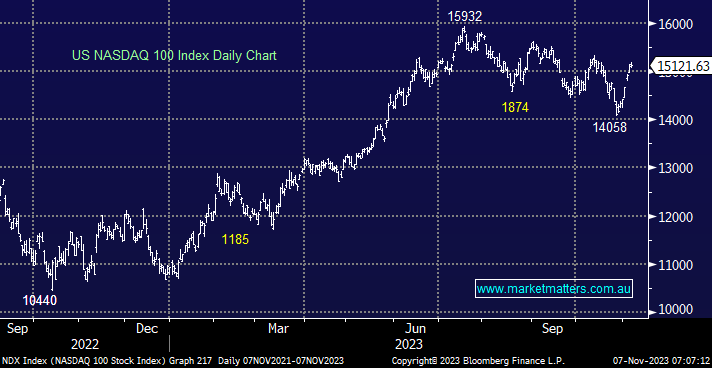

Overnight, US stocks eked out small gains in a relatively quiet session compared to the last week. A solid performance, in our opinion, following the market’s best week of 2023, the NASDAQ has spent plenty of time rotating around the 15,000 area over recent months, and we envisage more of the same before the next bullish catalyst sends stocks higher – Fed Chair Jerome Powell is set to speak twice in the coming days. Yields edged higher after last week’s sell-off, which probably was the main reason for the pause on the upside, NVIDIA rallied +1.2% into its earnings report as traders probably square up ahead of the likely post-report volatility.

- The NASDAQ looks ready for consolidation after its sharp rally, but we’re still targeting a break of 16,000 in 2023.

Excluding energy, US earnings are up ~10% year over year, but again, Big Tech was a huge contributor, if we take the “Magnificent Seven” out of the equation, earnings increased by ~3%. The biggest contributors have been Microsoft (MSFT US) and Meta Platforms (META) with high-flying NVIDIA due to report later this month.

- We are looking for META to test $US350 into Christmas, although a break of 2021 highs could prove a step too far.