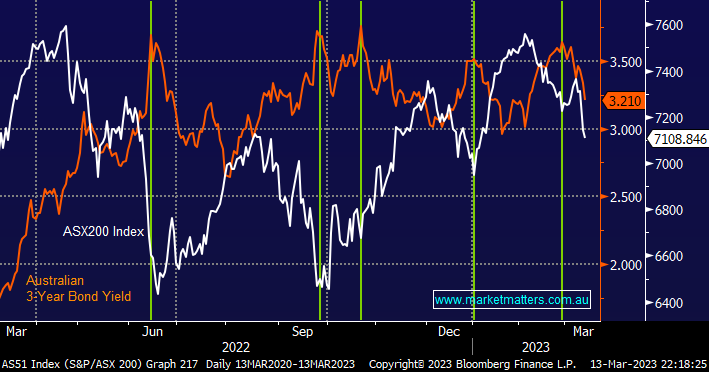

Through 2023 MM has been pointing out how equities were ignoring rising bond yields i.e. the previous 4 times we saw local 3-year yields above 3.5% the ASX200 was under 7000. However, ironically this month has seen the local index plunge towards 7000 as yields finally turn lower following the collapse of SVB – a great example of what drives markets transitioning over time.

- We migrated down the risk curve in January as we felt the risk/reward was unattractive as bond yields rallied towards 3.5%, this is now reversing as SVB sends shudders through equities.

- As panic selling washes through certain pockets of the market opportunities will undoubtedly present themselves.

When we stand back and consider the bigger picture it’s easy to see how falling interest rates have fuelled a stock market rally since the 1990s and especially post the GFC. Growth stocks and especially tech were the main beneficiary of interest rates heading towards zero and negative in many countries but while MM is looking for a short-term period of outperformance from tech stocks as bond yields fall we do prefer the value sector medium/longer term. The underlying ASX200 looks vulnerable if/when we see a rally above 5% by local short-dated bond yields on a pure valuation front.

- As interest rates normalise post the GFC & COVID we believe value stocks will outperform for at least a few more years.

- Stocks and in particular growth names have been revalued as bond yields rose, however, today it’s now all about repricing in risk following the collapse of SVB i.e. equities were complacent about the next “Black Swan Events”.

Last night we witnessed US banks and in particular regional names plunge lower taking the index of the latter down another painful -15%. As we often say with panic comes opportunity and today we believe that is exactly what is unfolding within the global banking sector – MM is underweight the sector in our Flagship Growth Portfolio and it feels like time to dust off the “Buy Button”.

- We now like the risk/reward towards slowly accumulating US banks but obviously on a stock-by-stock basis.