What Matters Today in Markets: Listen Here each morning

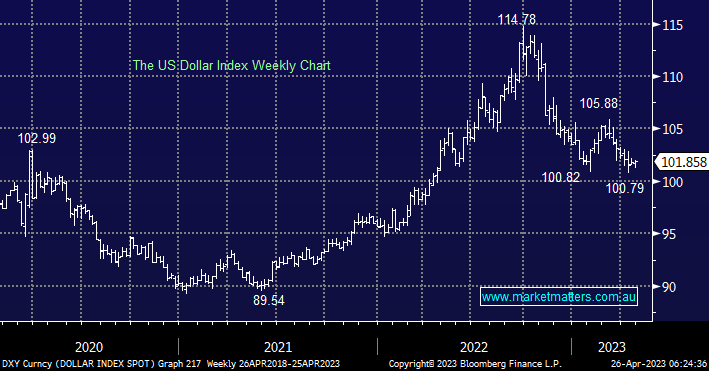

The last few weeks have seen the $US hold its 2023 low and threaten to recover some of its 12% decline since last September which is indeed MM’s preferred scenario over the coming months. A rally in the Greenback has some significant read-throughs for both the overall market, and more importantly for a number of specific sectors, a couple of examples of which have already started to shine through in the commodities space:

- Gold has already fallen ~$US75/Oz as the $US threatens to rally although most gold stocks have been resilient to the weakness in precious metals e.g. Evolution (EVN) has only sipped -6.5%.

- Copper has slipped -7.3% over the last 3 weeks weighing on high-flying Sandfire Resources (SFR) which has underperformed the industrial metal dropping -10% from its April high.

We are bullish on the resources sector medium/longer term but while recession fears remain firmly at the front of investors’ minds we believe there’s a strong possibility that Australian miners could experience a sharp pullback which is likely to bring some quality names back into our buy zones – MM has increased its flexibility/cash levels over the last few weeks with one eye firmly on increasing our resources exposure into weakness.

A strong $US also has an inverse correlation to the overall market including tech but at this stage, it looks like the Resources Sector is poised to give up some of its recent strong gains e.g. year-to-date Newcrest Mining (NCM) +40%, Northern Star (NST) +17.8%, Iluka (ILU) +15.6% and Sandfire Resources (SFR) +20%. However, we note the major iron ore-focused names are already struggling in 2023 e.g. BHP Group (BHP) -3.2%, RIO Tinto (RIO) -2.8%, and Fortescue (FMG) +1.2%.

- We are keen buyers of resources stocks into weakness but we are unlikely to increase our bulk commodity exposure i.e. iron ore and coal.

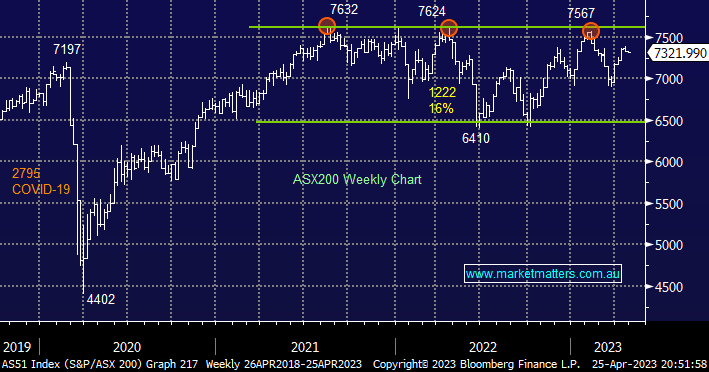

The ASX200 has looked tired over the last fortnight after its strong rally since late March and especially from October’22, while this shouldn’t scare the bulls we must remain cognisant of the local markets’ recent affinity to trade between 6500 and 7500 which would make it far closer to a sell than a buy.

- We believe at this stage of the cycle that a neutral stance is prudent i.e. better risk/reward is likely to present itself in the next 1-2 quarters.

After last night’s weakness on Wall Street, the local market is set to dip -0.5% with weakness likely to focus on tech and resources if we follow the US sector performance.