What Matters Today in Markets: Listen Here each morning

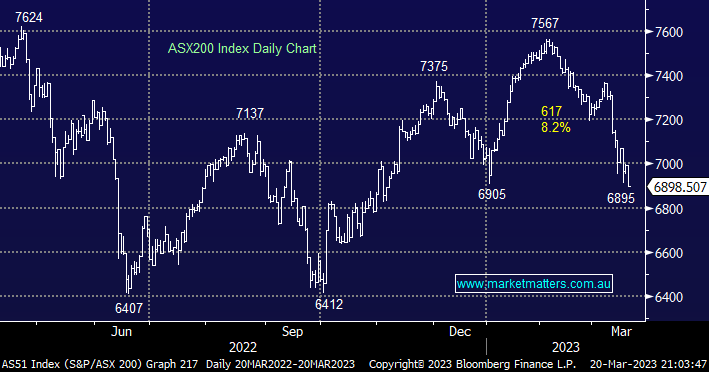

The ASX200 tumbled another -1.4% on Monday as broad-based selling saw over 80% of the main board close down on the day, outside of the gold names there was very little green on the screen although the banks weren’t as bad as many feared with the average fall by the “Big 4” less than 1%. The market tried to rally into lunchtime but as US futures turned lower the Australian market followed suit as the sheer magnitude of the UBS-Credit Suisse deal was digested by the already nervous market.

- Switzerland’s largest bank UBS has bought Credit Suisse for $US3.25bn, around 60% of what it was worth on Friday with the shareholders receiving UBS stock in the rescue package – the stock has fallen over 94% over the last 2 years with the bank losing investors’ confidence a long time ago.

- However the real damage was inflicted on AT1 hybrid investors with $US17bn worth of these riskier securities receiving nothing, a total loss of capital given the conditions written into these securities – more on this below.

- Unfortunately for share/some debt holders the deal requires no approval as the Swiss Government changed the law to ensure the deal would be complete before financial markets opened on Monday morning.

Although the local index fell almost 100 points the standout volatility was witnessed in the bond and fixed-interest markets as investors started to price in higher risks of failure into the likes of hybrids after digesting that the $US17bn of Credit Suisse debt was now worthless:

- Australian 3-year bond yields plunged back toward 2.8%, well below the RBA’s Official 3.6% Cash Rate, as cuts start to be priced in by futures markets.

- Westpac, Macquarie, and ANZ wholesale hybrids fell by 3-6% while securities issued by HSBC fell close to 9%, but ASX-listed bank hybrids fell around 1% in line with the underlying banks.

MM remains comfortable with the health of the Australian banking system but from an investment perspective, as we’ve alluded to recently, we see no reason to move to a market weight or overweight stance to the embattled banking sector which might take months to regain investors’ confidence. Over the last 3-6 months MM has been discussing the risks posed by rising interest rates on the integral Australian property market but a collapse in some of the US/European banks wasn’t on the menu unless property prices collapsed i.e. the chicken and egg switched places!

- Amazingly several “professional” financial institutions & banks failed to acknowledge that interest rates wouldn’t remain at zero forever and that when rates rise the price of bonds would fall meaning paper capital losses to the holders.

- Last year US banks were already carrying ~$US620bn of unrealised losses on their significant bond holdings i.e. it’s not surprising the Fed is keen to nip this banking crisis in the bud asap.

- The potential “mortgage cliff” will increase most repayments by around 30% with the RBA, who caused this very risk, sounding increasingly concerned over recent months i.e. 40% of fixed home loans will roll off in 2023 followed by a further 20% in 2024.

US stocks recovered strongly overnight as bank jitters eased as officials worldwide sought to shore up market confidence, the resources and energy stocks led the gains while tech which had just enjoyed its best weekly advance since September took a breather. The banking turmoil has helped risk assets in some way with markets reining in their bets that the Fed would hike their Funds Rate to 6% – futures markets are now pricing in a 70% chance of a 0.25% hike by the Fed this month but also 4 cuts over the next year.

Following the Dow’s +380 point recovery the SPI Futures are pointing to a 45-point rally this morning by the ASX200 which would recover half of yesterday’s losses – BHP closed up 70c in the US illustrating the overnight strength across the Resources Sector.

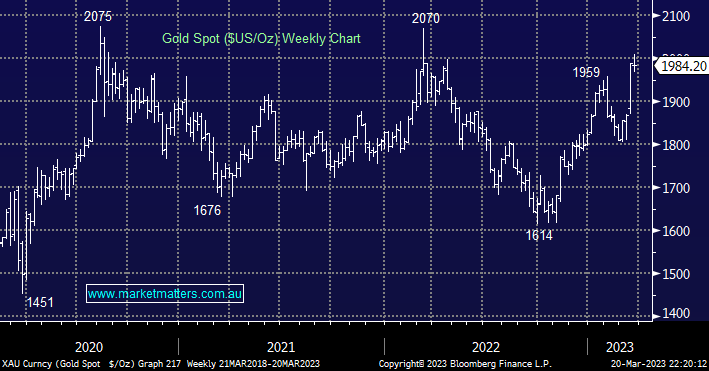

Firstly with so much doom and gloom around we thought it would be a refreshing change to start with a positive story i.e. gold which has surged over 10% since Silicon Valley Bank became a household name by becoming the 2nd largest bank in US history to fail. Investors flocked to safe havens which have seen gold enjoy a quick rally over $US200/oz, testing its 2-year high in the process.

- We like gold but it’s likely to encounter some decent resistance in the $US2,000Oz area, at least until we hear from the Fed later this month.