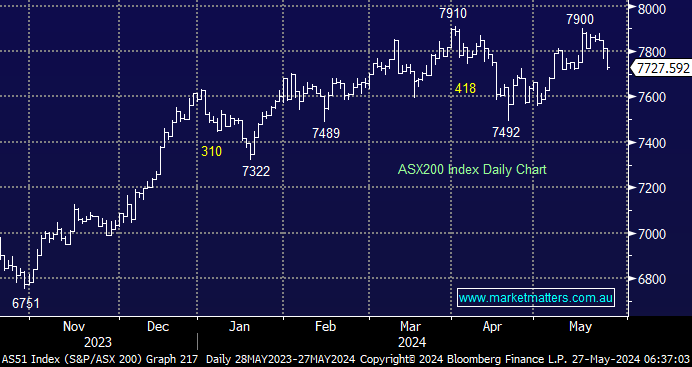

The ASX200 was whacked on Thursday and Friday after the Fed Minutes weighed on equities in general, but especially the miners, as gold and copper surrendered some of their recent gains – Copper fell 8%, and gold fell almost 5% into the weekend. However, we believe this is a pullback in both commodities and related stocks to buy, which should eventually help the local market’s performance compared to its global peers.

- We are still looking for the ASX200 to test the 8000 area over the coming months.

- The SPI Futures are pointing to a +0.6% gain early this morning, aided by a ~40c bounce by BHP in the US.

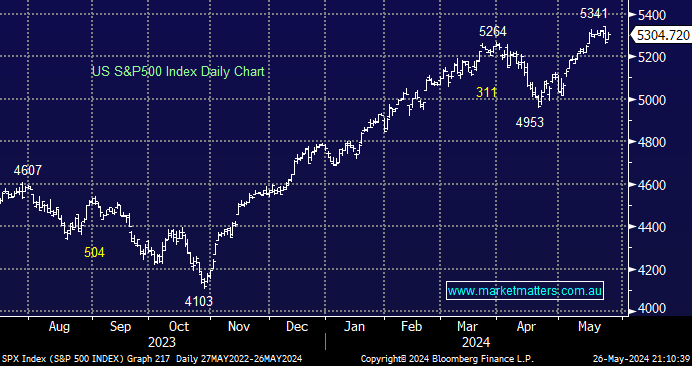

US equities pushed to new all-time highs last week, but the Fed Minutes curtailed the advance, at least for a few days. MM’s ideal roadmap is for stocks to again push to new all-time highs, but the risk/reward is questionable. We can see ourselves adopting a neutral stance in the coming weeks/months and moving down the risk curve accordingly.

- Over the coming weeks/months, we are initially targeting the 5500 for the S&P500, now less than 4% away i.e. a pop to new highs which ultimately fail.

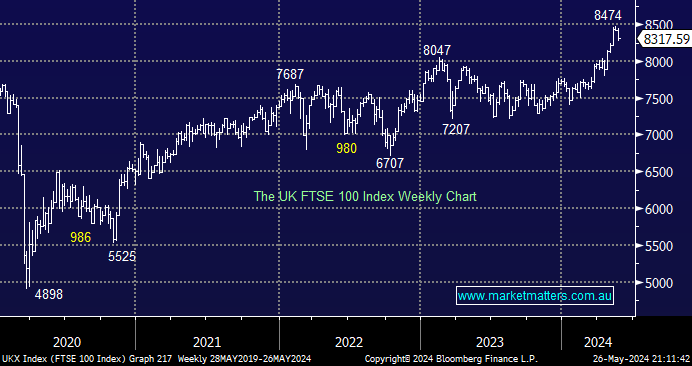

The FTSE pulled back last week in a very similar fashion to the ASX, but while we believe the risk/reward is fading for buyers around the 8300 area, we’re still looking for the UK’s market to push higher as the country faces an early general election in July – the betting odds are favouring a Labour victory after four consecutive Conservative terms.

- We can see the FTSE taking a breather, but if we are correct, April’s breakout to new highs still has some more upside.