The ASX200 is set to dip back towards 6850 this morning, posting a fresh 4-month low in the process. We still expect a strong recovery through November/December, but as we’ve said previously, from where has become the “million dollar question”. Taking into account the Middle East tensions and hawkish central banks, we now have to allocate a 25% possibility that the local index will test its 2-year support, back around the 6500 area, or ~5% below Friday’s close.

- The SPI Futures are pointing to a -0.9% drop this morning, with a ~$1 fall by BHP Group (BHP) set to weigh on the index.

US stocks slipped lower into the weekend, just managing to hold above their October lows by a few ticks. A retest of 4200 was not our preferred scenario at this stage, but we are sticking with our bullish skew, with the coming week likely to be critical to what comes next – if we were traders, as opposed to Active investors, we would be sitting on the fence waiting to buy a break of Octobers high looking for a run into Christmas.

- No change; we remain cautiously bullish towards US stocks as they test their October lows.

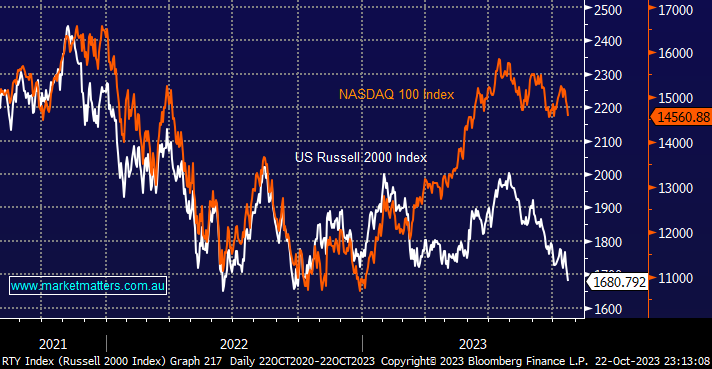

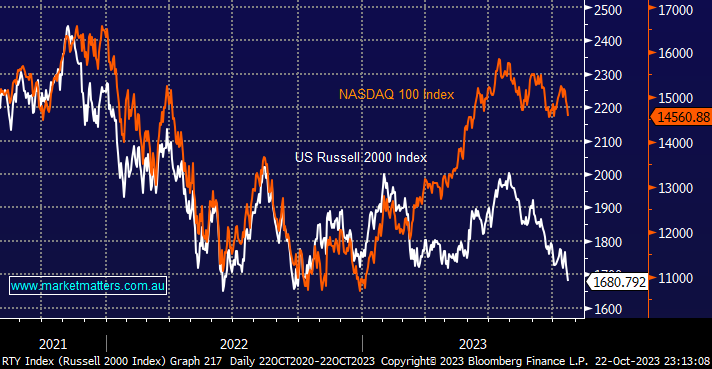

The US small caps have struggled since bond yields started rallying in late 2021, and the hawkish comments coming from the Fed look likely to maintain the bearish trend over the coming weeks. From a risk/reward perspective, we would be keen buyers of a “false dip” under 1640, but that still implies equities go lower before they can recover.

- A test of the psychological 1600 area looks possible over the coming weeks, i.e. ~5% lower.