The ASX Healthcare Sector has been looking increasingly strong over recent weeks, with many diverse members such as CSL Ltd (CSL), Cochlear (COH), Sigma Healthcare (SIG), Ansell (ANN), Fisher & Paykel (FPH), Pro Medicus (PME), and even Ramsay Healthcare (RHC) feeling more bullish into the back end of 2024. With investors struggling to find value, with the “Big Four Banks” nudging all-time/multi-year highs, and the Tech Sector already up over +20% year to date, it’s not surprising they’ve turned their attention to this old bastion of performance, which is up less than 5% so far this year. Until the Resources Sector latches onto some positive news from China, it is where MM sees some of the best risk/reward opportunities.

- We are looking for outperformance by the Healthcare Sector through to Chirtsmas.

Hence, our next question is, what stocks do we want to own in the Healthcare Sector? Currently, we have 4% in CSL Ltd (CSL) and 5% in Ramsay Healthcare (RHC), with the latter a drag on our Active Growth Portfolio over the last 12-months. In terms of sector weighting in the ASX, it is currently ~10%; hence, we are slightly underweight in a sector we like moving forward. As we mentioned earlier, we like a number of healthcare stocks at this point in time, but after re-evaluating them, we opted to remain with RHC as a recovery play and CSL as a quality growth company – the market is currently largely risk-averse outside of tech & AI which should assist CSL. As for RHC, it is “now or never time”, although it may endure some tax loss selling into June 30th.

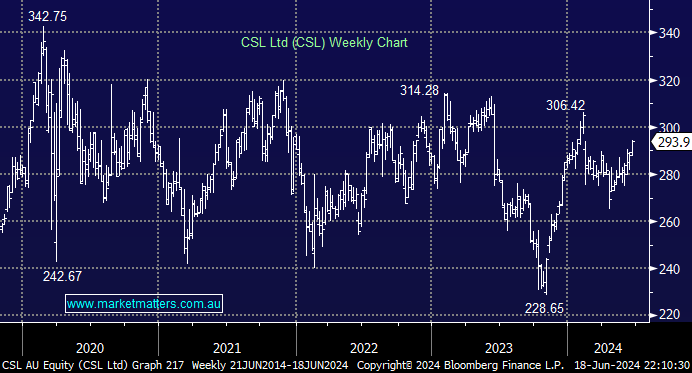

As a prominent ASX stock, it is not surprising we’ve discussed CSL a number of times over the last 12 months, with one line in our last mention summing up our thoughts- “This blood plasma giant would be on our shopping list if we weren’t already long.” The recent feedback from CSL at Macquarie’s Investor Conference was very encouraging, and we believe markets are being slow to focus on the stock’s upside from sub $300, i.e. we are looking for a retest of the $330-340 area.

- CSL reiterated FY24 guidance (NPATA +13-17%) and also issued longer-term targets for double-digit EPS growth and an ROIC of 20% by FY30, in part supported by a margin recovery in Behring.

- Also, partner Terumo recently revealed that the rollout of the new Rika plasma collection system had picked up pace, making this year’s targets look very achievable, reaffirming the logic behind the FY24 reaffirmed guidance.

A point of interest is that we often say that MM rarely averages losing positions unless it was in the original plan to accumulate into weakness. However, we are far more comfortable increasing a winning position into strength, a characteristic that’s missing from many investors’ DNA. Our CSL position is currently showing a ~9% paper profit, and we are considering increasing it. Remember, over the last year, the strong have gotten stronger and vice versa.

- MM is likely to increase our CSL position – watch for alerts.