CSL dominated talk across trading desks on Tuesday with their messy, but not particularly bad, result causing the stock to be punished almost 17%, its worst fall since the GFC. We’ve seen stocks perform better after announcing aggressive capital raises! This was an eagerly awaited result, and the stock had rallied almost 18% since late June but those gains became a distant memory by Tuesdays close with the stock making new 6-year lows. The company announced a FY25 profit up 17% to $3.2bn, inline with consensus, but the quality of the result saw the market wipe ~$22bn off the company’s market value in rapid fashion.

- Revenue at CSLs main Behring unit missed estimates while its net profit was boosted by a lower tax rate.

- FY26 earnings guidance at the group level was around 10% below expectations, further muddied by a restructure.

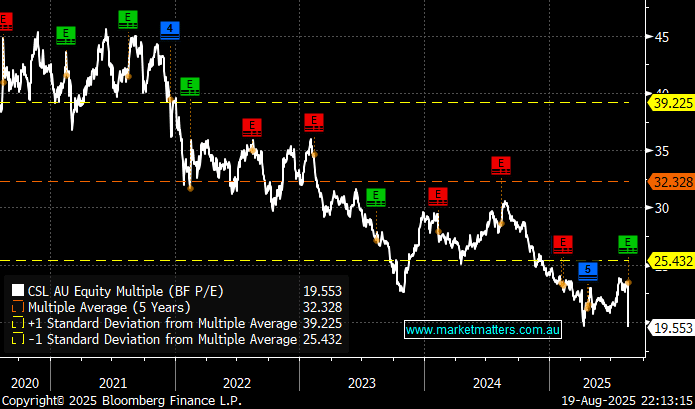

The savagery of the selling echoed a market “caught long/overweight,” all looking for the exit door at once. With the stock testing its lowest valuation in many years, the obvious question is how we see the stock trading moving forward. Most people we spoke to yesterday were talking about where to buy the sell-off, but like all markets, we should be open-minded and also consider whether/where to sell. The major overhaul of the business was arguably required to allow CSL to focus on what it does best:

- CSL is “spinning off” its Seqirus business, which is lower growth but a solid earner. Seqirus alone reported $US2.2 billion in sales in FY25. It accounts for around 15% of the company’s profit and could be big enough to be a standalone ASX100 or ASX50 company.

- They are also consolidating their R&D sites from 11 to 6 to reduce costs by ~$500mn pa. – the sort of news investors usually embrace.

- Thirdly, they announced a multi-year buyback starting with $750mn in FY26, which many thought was a move to appease the market.

It’s important to recognise that the numbers weren’t too bad, after a strong year during which earnings were up 14%, cash flow grew 29%, and the company announced a $750 million share buyback. The R&D model has always been at the heart of its success, but its long-term approach appears to have become too complex, hence the announced simplification, which makes sense. To MM, it feels CSL has been forced into major surgery, with more than a hint of financial engineering. The changes may prove attractive over the years ahead, but the restructure adds a level of execution risk and uncertainty to the story just when investors are were losing confidence.

- CSL is trading around its lowest valuation in 5 years after an overweight market dumped the biotech on Tuesday – note we didn’t call it cheap.

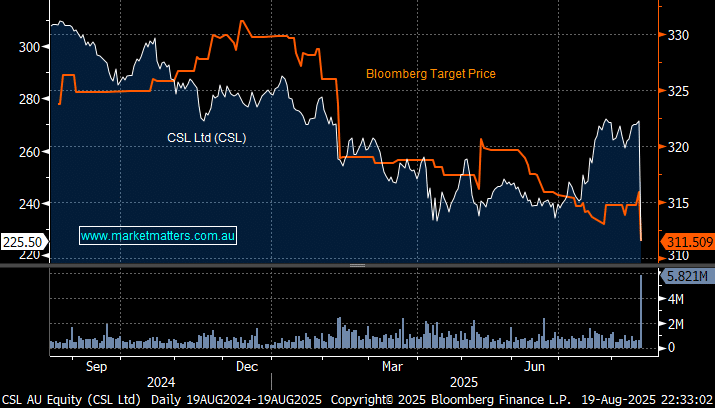

The market was wrong and that rarely goes well, at yesterdays close the average analyst target price according to Bloomberg was $311.50 while the stock plumbed to $225, over 27% lower. Downgrades have started although they are still 10-20% above yesterday close. The volume illustrated on the chart below shows how the market almost panicked as momentum gathered on the downside. We believe CSL is now providing some value for patient investors but it may a long while for it to fully regain the markets confidence.

- We can see CSL trading between $205 and $245 over the coming weeks/months but we have no plans to average our underweight 4% position: MM holds CSL in its Active Growth Portfolio.