After CSL’s aggressive sell-off last month, it’s been the topic of conversation with many investors caught long this much-loved $99bn healthcare giant. We discussed CSL in detail following August’s result, which led to the sell-off despite earnings being up 14%, cash flow growing 29%, and the company announcing a $750 million share buyback. However, FY26 guidance fell 10% short of expectations, and the “spinning off” of its Seqirus business led to questions about future growth, with the business forced into major simplification plus a degree of financial engineering.

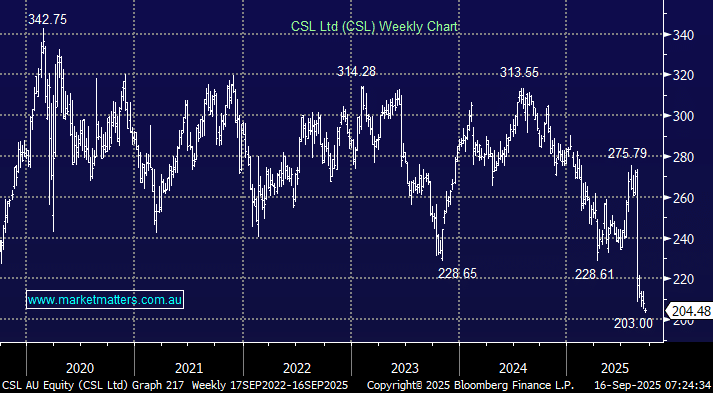

The re-rate lower in CSL has been significant, however it now trades on 18x and looking out for the next 3-years is still growing earnings at above 10%. It feels like a tremendous amount of bad news is already built into the stock. The stock is finding a base around $200 as the post result washout style selling is losing momentum.

- We like the risk/reward towards CSL around $200.