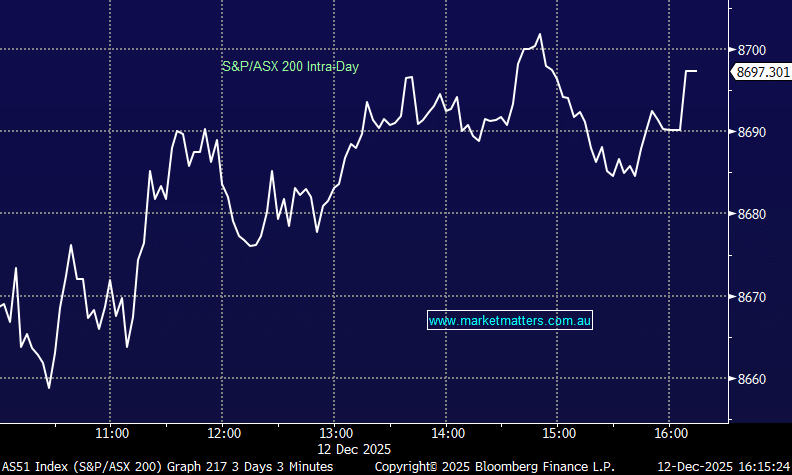

CSL –4.95%: The share price reaction today was indicative of the messy result delivered by CSL, with a few moving parts to cover below, though they did say they are on track to achieve FY guidance, which is for revenue growth of 5-7% (on a constant currency basis ) and adjusted net profit growth of 10-13% (CC basis). The market was initially appeased by that, pushing the stock higher, though, that was short lived with sellers emerging post the 11am conference call;

- 1H25 revenue of $8,483m, up +5% and in line with consensus

- Underlying gross margin 55.5%, was down –35bps and below consensus

- 1H adjusted net profit of $2,074m was up +5% on a constant currency basis, around 5% below consensus

As flagged above, some moving parts in the result;

Behring , which specialises in the development and manufacturing of therapies in immunology, hematology, and critical care performed well. Vifor, specializes in iron deficiency and while they topped revenue expectations , margins were softer, while Seqirus, one of the largest global players in the influenza vaccine industry was negatively impacted by weak performance in the US flu market.

- Overall, a messier result and that’s part of the problem for CSL at the moment, though, we’re a little surprised the market reacted so negatively given how weak the stock has been trading ahead of today’s update, with the stock trading on its lowest multiple in more than 5 years.