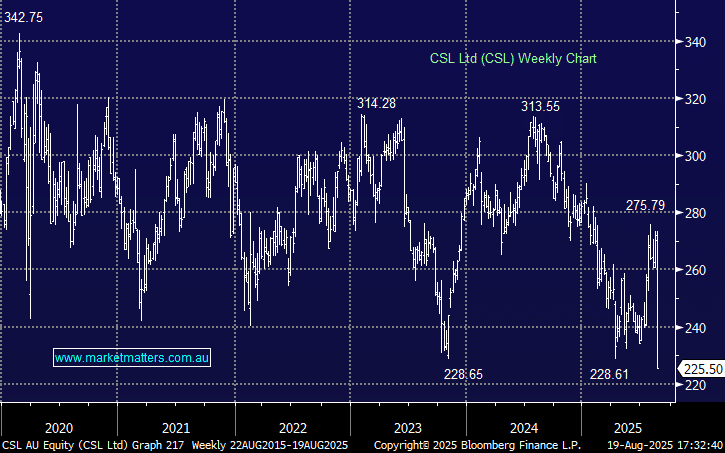

CSL –16.89%: Shares experienced their worst fall since 2008 after the FY25 result highlighted weakness in the Behring division and revealed a major strategic restructure including a spinoff of Seqirus, which has created more questions than answers.

- FY25 revenue $15.56 billion (+5.1% y/y) estimate $15.76 billion

- Net profit $3.22b (+11% y/y, vs estimate $3.17 billion

- Behring division at $11.16b (+5.2% y/y) but flat Immunoglobulin (IG) growth in 2H

Vaccine unit Seqirus will be demerged in FY26, alongside a planned A$750 million buyback, >$500 million in targeted annual cost savings by FY28, a 3000-person (15%) workforce reduction, and the closure of 22 plasma centres with one-off restructuring costs expected at $700–770 million pre-tax.

While the spinoff, buyback, and cost-out program might be attractive long-term, investors are still erring on the side of certainty – the restructure adds a level of execution risk and uncertainty to the story, and the cynic would say companies do these sorts of things to disguise underlying issues.