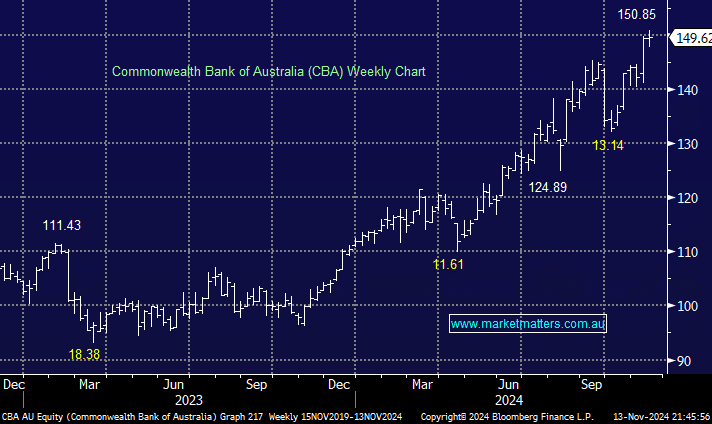

CBA has confounded the bears through 2024, but after yesterday’s trading update, solid as it was, it’s hard to comprehend the stock surging ahead through $150. With a forecast yield of now only 3% fully franked over the next 12-months, the stock is screening very rich to MM. However, we still prefer the “buy the dip” approach instead of selling the strength. The bears will become vocal next time CBA dips over $10, but we believe it will be time to set the “buy traps”.

- CBA had already provided three excellent buying opportunities when it corrected well over $10 in the last 18 months; we believe another is on the horizon.