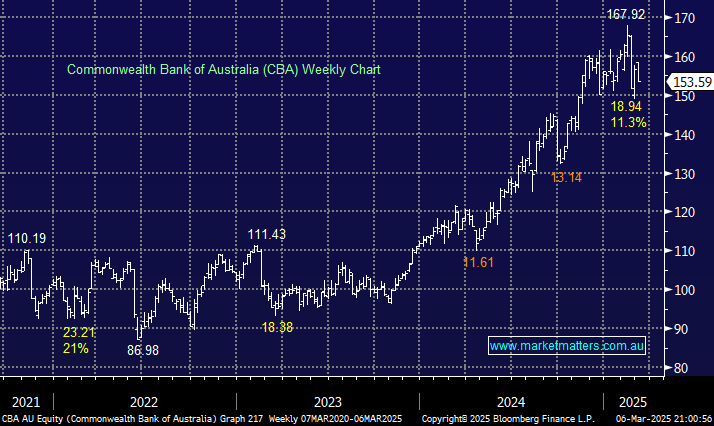

CBA may be a world-class bank, but it dragged the ASX lower yesterday; the million-dollar question is where to buy Australia’s largest listed company, whose valuation stretched to unprecedented levels in February. However, as we saw on Thursday, the bank is under pressure as sellers target high-value names and those looking vulnerable to rising long-dated bonds. It’s important to remember that pullbacks of this magnitude are common for CBA, although we believe it’s still too early to start buying from a risk/reward perspective.

Interestingly, around seven months after several high-profile local hedge funds disclosed they were betting on a sharp fall for one of the world’s most expensive banks, the short positions in CBA are now at the lowest point in almost two years after they’ve thrown in the towel. Ironically, following this capitulation, the bank looks capable of lower prices, although it’s still above the $140 area where it was trading when talk of shorting the bank echoed loudly.

- We hold CBA in our Active Income Portfolio while having it in our Active Growth Portfolios Hitlist – we like CBA in the $145 area, or 6-8% lower.