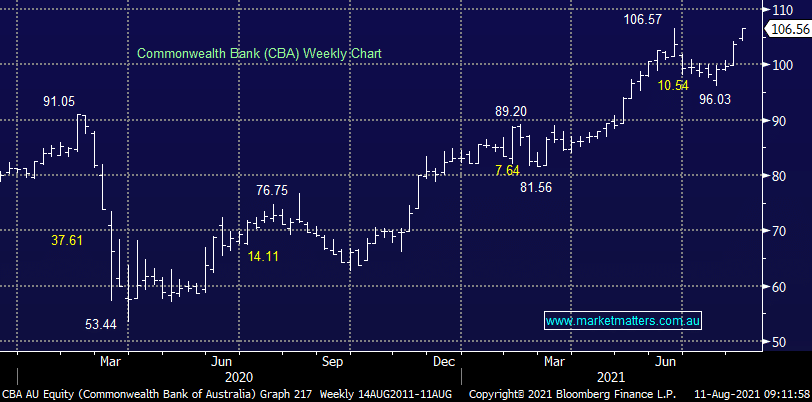

FY21 Result: A big result was expected and is clearly priced into the market with CBA trading at all-time highs of $106.56 – and they’ve certainly delivered on that this morning. Cash profit for FY21 from continuing operations was expected to be $8.6bn, they’ve delivered $8.65bn which is up 19.8% on FY20. A full year dividend of $3.42 expected (2H dividend of $1.92 which is up from $1.50 in the 1H) and they’ve delivered $3.50 ($2.00 in 2H).

Cash earnings per share expected of $4.76 & they’ve delivered $4.89 while Tier 1 capital sits at a healthy 13.1%, up another 150bps. Loan impairment expense was very low at just $554m or 7bps. That compares to $2.5bn in FY20 or 33bps. Net Interest Margin (NIM) of 2.03% when you think about it in this sort of low rate environment is very impressive.

Importantly, the market was expecting a large $5bn off market share buy-back although lockdowns had some analysts questioning whether this would eventuate, instead thinking more along the lines of a smaller on-market structure. Instead, CBA have delivered a big $6bn off-market buy-back which will result in a reduction of share count by ~3.5%.

In terms of expectations for FY22, the market is expecting revenue growth of ~3% and profit growth of ~8% driving a 13% increase in dividends which takes it to around $3.90 in FY22. To put that number into context, in FY18/19 they were paying $4.31.

Their outlook today was cautious which is understandable, however CBA is in great shape.